That’s a question that’s been around for years, but one that’s being asked more and more these days.

One clue could be – but probably isn’t – Aetna CEO Mark Bertolini’s evolving view of the purpose of health insurance and healthplans.

Bertolini’s personal brushes with mortality (a horrific skiing accident and his son’s cancer diagnosis) have fundamentally changed how he sees the role of health insurance. Unlike other insurance executives, he is pushing Aetna to deliver health defined as “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity,”

That’s what we do in workers’ comp, admittedly not all that well some times, but that’s our goal – prevent accidents and illnesses, get people healthy and functional if they do get hurt, and keep them that way.

I agree with Bertolini’s perspective.

That being the case, CWCS seems like a valuable asset indeed with exactly the right people, technology, business models, and intellectual property Bertolini needs to transform Aetna.

The question is, does Bertolini understand what he has, or will Aetna continue to treat CWCS as a purely financial asset?…a tiny part of a huge healthcare company valued not for its potential impact on the company as a whole, but for the dollars it delivers to the bottom line.

Rumors persist that CWCS is on the block, rumors without solid evidence behind them. As the work comp services industry continues to consolidate, CWCS’ name will continue to come up in conversations whenever investors are contemplating the next big deal. While it is indeed possible Aetna will entertain offers for CWCS, the division’s value (as a financial asset) has likely decreased over the past few years. CWCS’ core asset, it’s provider network, is not the dominant force it once was, the bill review business has dropped off, and under-investment throughout the division has hampered innovation.

What does this mean for you?

Sometimes exactly what you need is right in front of you.

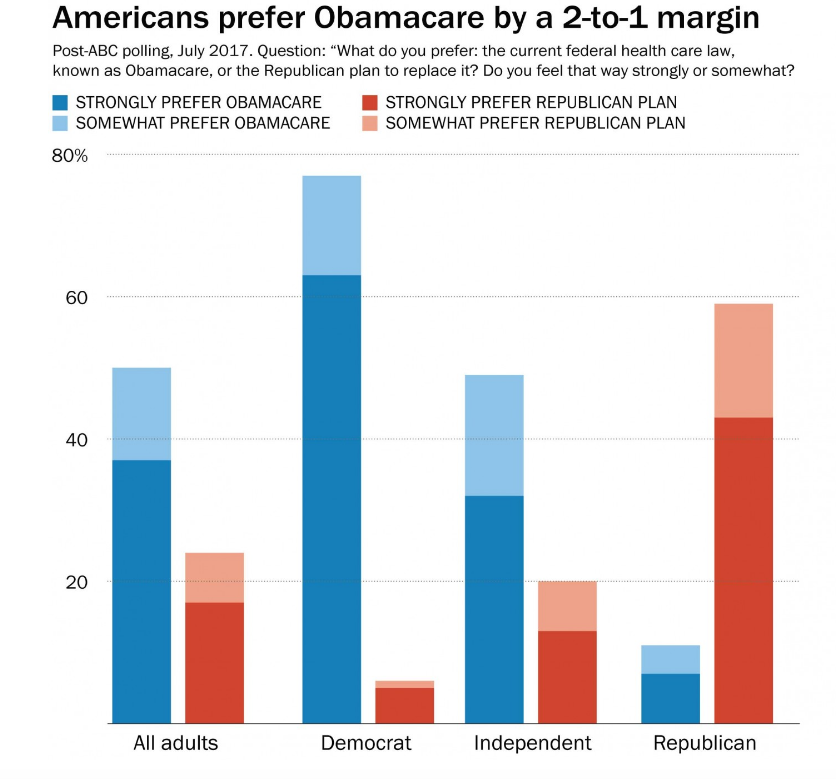

However, Republicans like repeal and replace. So, McConnell et al are stuck with a terrible choice – pass repeal and replace legislation that most Americans don’t want, or pass legislation that their base wants.

However, Republicans like repeal and replace. So, McConnell et al are stuck with a terrible choice – pass repeal and replace legislation that most Americans don’t want, or pass legislation that their base wants.