Someone who doesn’t do what you do may think it looks pretty simple.

Carpenters look at a house and see detailed planning, careful material selection, precise measuring, and skilled craftsmanship because they know what it takes to build a strong, sturdy, attractive, functional home. They are experts due to years of experience and hard-earned lessons and mentoring by their elders.

Me? I see walls and a roof. Building looks simple to me; get some lumber, nails, and tools, plus some other building stuff like shingles and wire and concrete, and start slapping stuff together.

Which house would you want to live in?

The same is true for any profession – teaching, medical bill processing, hitting a golf ball…right? Professionals – and we are all professionals in our chosen vocations – understand the complexity in what they do, while outsiders tell us it looks simple to them.

I’m thinking about the Presidential candidates’ positions on health care and health care reform. Trump wants to “rip out Obamacare root and branch” and replace it with something much “simpler”.

In general, Trump’s calling for:

- allowing insurers to sell health insurance across state lines

- repealing the individual mandate

- requiring insurers to cover anyone regardless of their pre-existing condition.

Sounds great…you don’t have to buy health insurance until you really need it, but the insurance companies still have to sell it to you even if you need a heart transplant or new kidney or are having premature triplets. (We discussed the across state lines thing here)

Here’s where those “details” matter.

What will insurance companies do if they are required to cover people who don’t need to buy insurance until they get sick?

They have two choices – go bankrupt or stop selling insurance to individual sand families.

What do you think they’ll do?

Of course they will stop selling health insurance to individuals. When that happens, the Paduda family, and most of the other 11 million folks insured thru the Exchanges will find themselves with no health insurance and no one to buy it from.

Then what?

Here’s the point. We live in an amazingly complex world, one where there are NO simple solutions. I know, simple solutions are really appealing, but “see the ball, hit the ball” only works until you step up to the plate, when it gets a whole lot more complicated.

If health care reform was easy, it would have been done decades ago. It’s messy, complex, and there are no simple solutions where everyone wins. It requires consideration of the “what then” issues. When you move one lever, it triggers a whole bunch of reactions that, if not anticipated, will create way more chaos.

Yes, the ACA is messy and needs fixing. Yes, we need our politicians to engage, debate, argue, and work it out. What you and I do NOT need is a sound-bite solution that is NO solution at all.

What does this mean for you?

If you think health care is a mess now, can you imagine what it would look like if people could wait to buy insurance till they were sick, and insurers had to either sell it to them or stop selling insurance altogether?

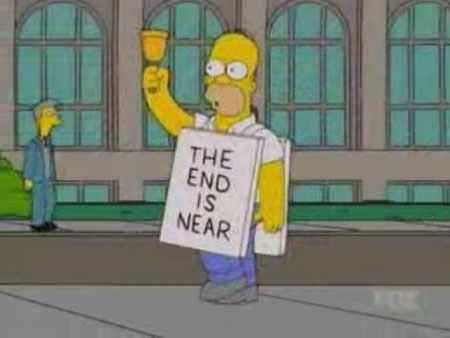

It would look like this