It’s the busy time – budgets, 2016 planning, getting those revenues in before year end. Tough to keep track of important stuff – no worries that’s what we at the Intergalactic Headquarters of Health Strategy Associates are here for!

First, a brief comment on the Cadillac Tax. The cries for repeal are ill-advised and politically driven – even if they have the support of both Bernie Sanders and many in the GOP. Fact is repealing the Tax would cut Federal revenues by $87 billion; notably those calling for repeal haven’t figured out how to replace the lost income.

Under PPACA, hospitals, health care providers, insurers, drug companies, device companies are all paying their share to help reduce the number of uninsureds. Yes, some union members and highly-paid executives with rich benefit plans are going to pay slightly higher taxes – but that’s because they are lucky enough to have incredibly generous benefits.

Whatever happened to shared sacrifice, to working together to solve big problems, to Kennedy’s call to ask not what your country can do for you but what you can do for your country? We constantly hear politicians talking about making America great; that doesn’t happen without sacrifice from all of us.

It’s time to for Sen Sanders, his GOP allies, and highly-compensated workers and executives to stop whining, suck it up, and do their part.

Okay, that’s off my chest.

Helios has published their latest update on regulations and legislation affecting pharmacy issues in work comp. A helpful document to file away for future reference.

NWCDC – the Vegas confab looks to be a big event this year; don’t forget to register for the Women in Workers’ Comp Leadership event here. It will be held the day before the Conference officially begins.

In the shameless self-promotion department, the must-attend session is the Blogger’s Panel on Thursday at 3:30. See Mark Walls do his level best to maintain order among chaos as Becky Shaffer, David DePaolo, Bob Wilson and I opine on the great events of the day.

Bob and I will be joined by John Plotkin and Bob Reardon of ISG at ISG’s event at 5:30 on November 11 – we’re going to discuss social media as a force for good in the work comp industry. Make sure to register here.

WorkCompCentral’s CompLaude Awards Gala will be held December 5 in Burbank.

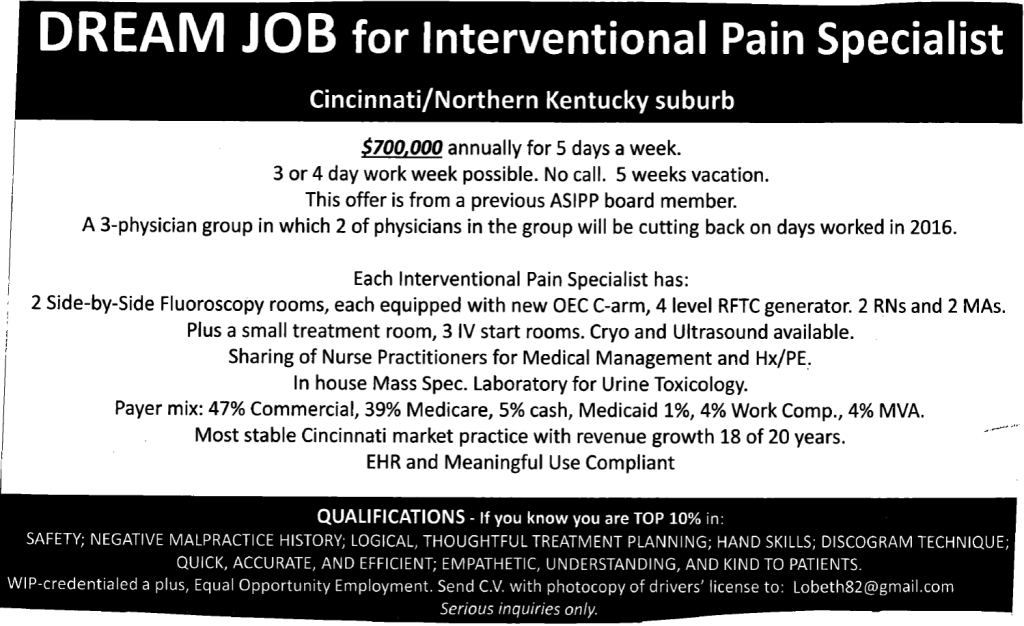

Finally, for those docs looking to increase their income, here’s a GREAT opportunity.

As a colleague noted, if the new guy is making $700k a year, how much are the partners making??