I connected with CWCI President Alex Swedlow – and good friend and colleague – to find out what’s been going on in the Golden State and what the annual confab will feature.

Here’s the registration info.

note highlights are mine.

MCM – Please briefly describe the workers’ compensation industry in California…frequency, disability duration, cost drivers, outcomes, market share of major payers.

Alex – California has the biggest WC system in the county, bar none. Whether it’s premium, frequency, medical care delivery volume, expenses. We’re a high litigation state with significant friction costs.

That said, our state has accomplished some remarkable changes and improvements through legislative reforms, regulations, and payer’s delivery systems that have significantly improved the efficiency and effectiveness of benefit delivery to CA injured work force.

MCM – I hear there are concerns about access to care in California for workers’ comp patients. What does the research say?

Alex – Access to care is a national crisis that is just now reaching full awareness. We are all waiting longer for access to specialists whether you are hurt on the job or during a weekend softball game.

The concerns about access within WC has been a research topic for CWCI for 25 years. Our most recent studies show that during the acute care phase (90 days) and the first year of treatment following the injury, the CA WC system delivers most services within a few days of the injury with little change in the mix or volume of professional services over the past 5 years. Expensive, yes. But a remarkable and stable result.

Let’s remember that workers’ compensation represents less than 2 percent of the CA healthcare economy.

Also, the National Institutes of Health project CA will be short 35k physicians and 45k nurses by 2030 with almost 1 out of 3 physicians retiring within 5 years. So right out of the gates, our system has very little leverage for addressing this problem. This makes our current medical delivery systems all the more remarkable.

MCM – Thinking about the various sessions, which one will have the most long-term impact on workers compensation and why? I noted a panel will explore the impact of exogenous influences on workers comp…can you give our readers a couple of examples and their impact?

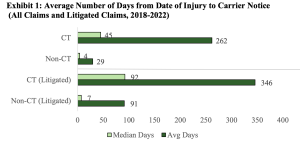

Alex – The theme of our 60th Annual Meeting is “An Altered State”. We will explore how our system has expanded well beyond the original “Grand Bargain” and into its current form and function. We will also focus on key bread-and-butter issues including fresh research on claim development, medical service delivery and dispute resolution, the controversial medical legal fee schedule, COVID, and that great, unique to CA imponderable, Cumulative Trauma claims. These are all issues that originate within our system.

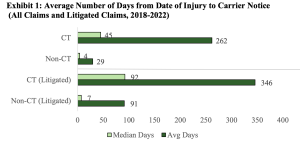

CWCI just published a study on this (free to all here); here’s a top takeaway:

In 2022, CT claims represented more than one out of three litigated claims. And, as Alex notes, CT is a “condition” unique to California.

I smell something…and it isn’t a rose.

(back to Alex)

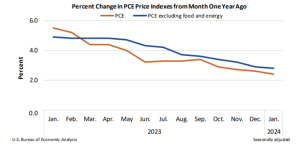

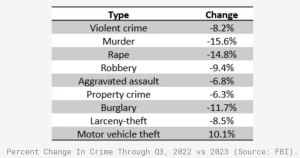

We will also explore exogenous influences, trends and issues that originate outside of our system that nonetheless have a significant influence on CA WC. We will preview the results of one of the first studies to use our state’s CURES system (California’s prescription drug management program) which captures all control substance prescriptions issued to all Californians across all payer groups. The results show state-wide changes in opioid use over a 5-year trend. The study also provides a look into simultaneous prescribing patterns across payer groups.

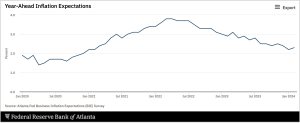

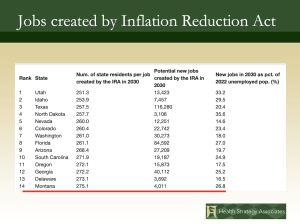

Other sessions will address our state’s economy, political climate, the looming $70B budget deficit, workforce migration, access to care, and some key interstate comparisons that show how much CA WC has changed over time.

Joining our staff, we have two great guest speakers from the Public Policy Institute of CA, Sarah Bohn and Eric McGhee, who will present new data on specific external forces that impact the vitality of our WC system. In addition, our long-time colleague, Ramona Tanabe, President of WCRI will discuss interstate comparisons to show how CA WC has evolved relative to other states.

What does this mean for you?

If you want to know, you’ve got to go.