The average California MSA includes almost $49,000 for drugs – about half of all future medical expenses.

69% of MSAs included funding for opioids.

But when researchers compared the MSAs to a

“case-matched control group of closed workers’ comp permanent disability claims for similar injuries, the authors found that the WCMSAs called for much stronger opioids, as average cumulative morphine milligram equivalents (MMEs) allocated to WCMSAs with opioids were 45 times the level used in the control group during the life of the claim.” [emphasis added]

Why?

Especially when the report goes on to say:

Federally mandated formulae to financially account for decades of sustained individual opioid use are at direct odds with a growing body of clinical evidence — and a widespread recognition — that opioids are often over-prescribed for the management of chronic, non-cancer pain.

The Feds want/require employers and insurers to pay for another 20 years of opioids, at relatively high doses, for claims that should not be getting opioids.

This is what makes all of us nuts; one hand of the government is pushing us to assertively reduce opioid use, while the other hand demands we pay for opioids for another two decades.

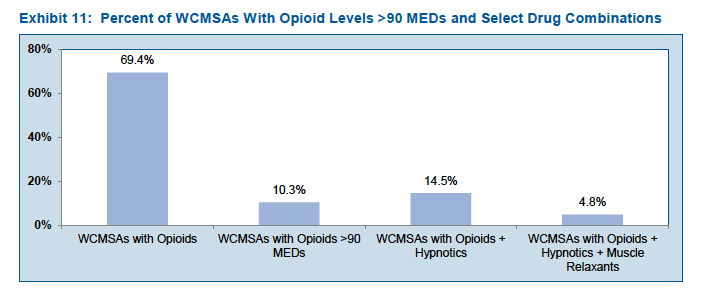

Worse still, many of the MSA patients are also taking hypnotics and/or muscle relaxants.

[chart courtesy CWCI]

A couple thoughts…

The claims with MSAs may well be those that payers can’t resolve, where the patient, their attorney, or their provider just won’t cooperate in efforts to reduce opioid use. Thus, the MSA projections make sense.

Why are these patients being prescribed – and ostensibly consuming – a high volume of opioids for an extended time when clinical guidelines and best practice clearly contradict this practice, and other patients with similar conditions aren’t getting these drugs?

What does this mean for you?

We are making progress, but we have a very long way to go – and CMS isn’t helping.