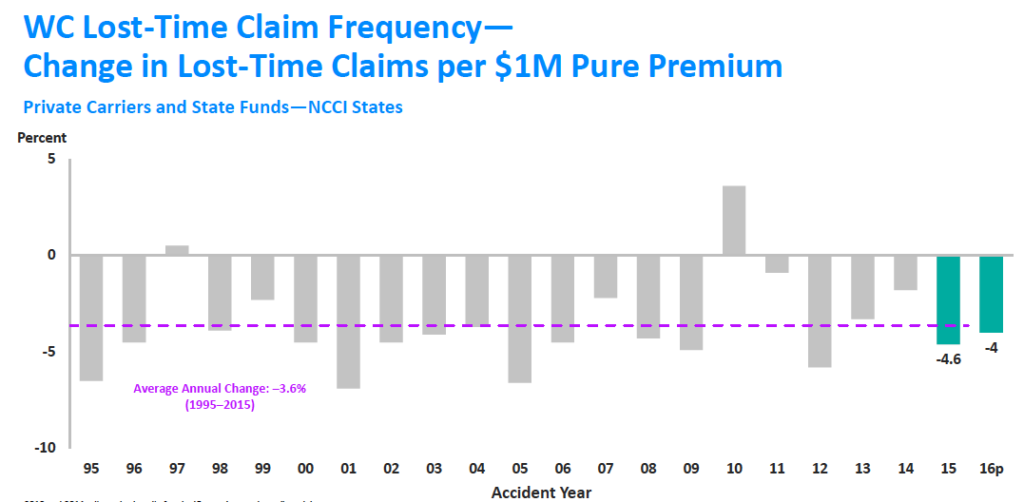

In 2020, there will be 10 percent fewer claims than there are today.

In 2023, there will be 20 percent fewer. That’s about 1.2 million fewer claims.

excerpted from NCCI AIS 2017

The workers’ comp industry is shrinking, and while there may be bumps in frequency from time to time, the overall decline is inexorable.

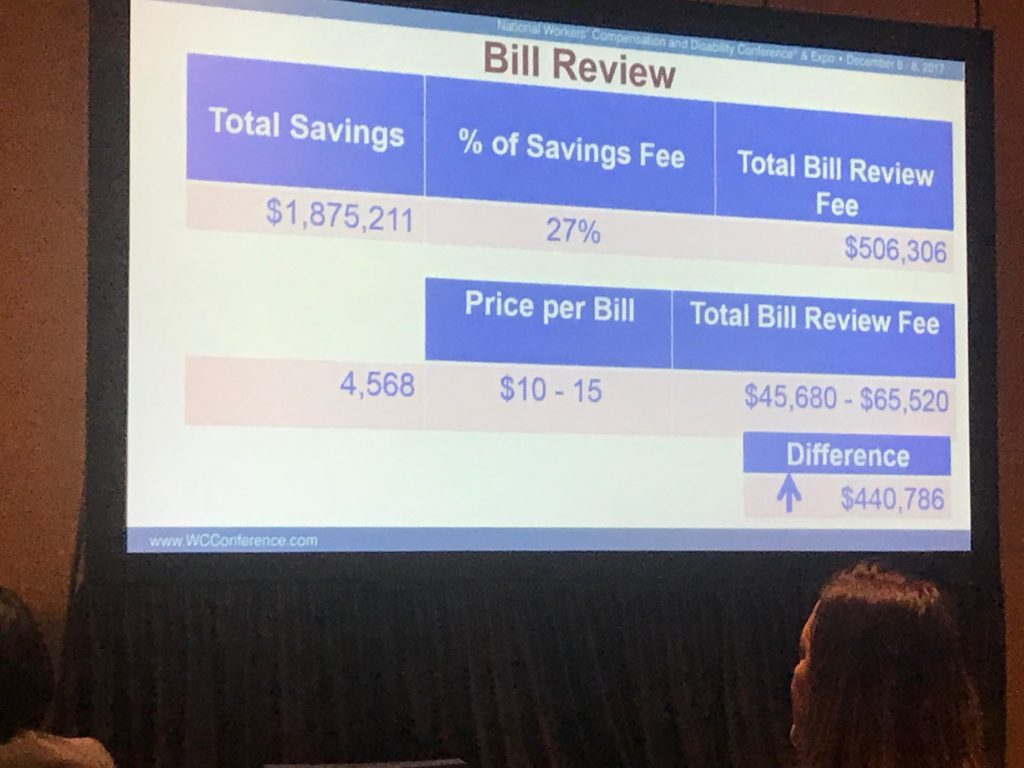

There are immense implications, implications that I’m not sure enough of us are thinking through. For example, fewer claims means the industry needs fewer adjusters, case managers, bill reviewers, UR staff, investigators.

It also means capital investments in technology have to account for the world that will exist when that new tech is up and running. Millions of dollars are at stake here; insurers (primarily) that chronically underinvest in IT have to evaluate whether there will be enough claims and premium to support their required internal rate of return.

HR staff are focused on trying to get young people into the business…how many new workers will a) want to work in a disappearing industry and b) really are needed?

A couple other things to consider:

- regulators – if the business is shrinking, will regulatory staff and their work product decline?

- provider interest in workers’ comp will likely drop, especially because Medicare and Medicaid are likely to grow in importance

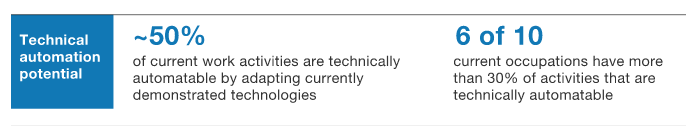

I’d be remiss if I didn’t note that automation and artificial intelligence may actually accelerate the drop in frequency as large chunks of the blue-, pink-, and white-collar job market disappear when functions are handled by machines.

This isn’t a bad thing. Fewer injuries and illnesses means fewer hurt people.

But it also means an industry that relies on addressing injuries is being forced to adapt.

What does this mean for you?

This is going to be painful indeed, especially for those people and companies that don’t think this through carefully and intelligently.

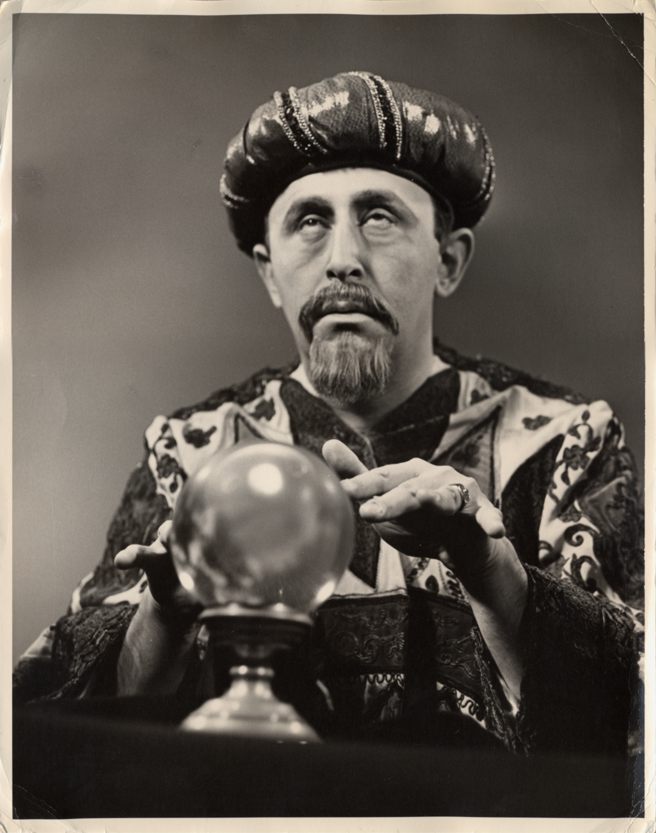

Clearly not a self-portrait; I could never grow that facial hair…

Clearly not a self-portrait; I could never grow that facial hair…