The coverage of the JPMorgan/Amazon/Berkshire Hathaway healthcare initiative has been universal, breathless, and mostly superficial.

Scoffers, “experts” are gleefully predicting this attempt to do something really different will fail miserably, victim of ignorance and hubris. While there are no guarantees, these naysayers ignore:

- the three CEOS and their staff are brilliant, powerful, have almost unlimited resources, and are very, very cognizant of the difficulties they face. These are as far from idealistic newbies as one could get.

- the “competition” is pretty lousy, hasn’t delivered, and their incentives are NOT aligned with employers’. If the big healthplan companies could have figured this out on their own, you wouldn’t be reading this. It’s not like A/B/J are taking on Apple, Salesforce, or the old GE.

- the financial incentives are overwhelming; healthcare costs are over $24,000 per family and heading inexorably higher. Unless these companies reduce and reverse this trend, they’ll have a lot less cash for future investments.

Many are also talking about “initiatives” that are little more than tweaks around the edges; things like:

- publishing prices and outcomes for specific providers aka “transparency”

My view – research clearly demonstrates consumers don’t pay attention to this information, so there’s no point - using technology to monitor health conditions and prompt treatment/compliance

My view – lots of other companies are already doing this, and this is by no means transformational - use buying power to negotiate prices

My view – it’s about a lot more than price, it’s about value.

Here’s a few things A/B/J may end up doing.

- Own their own healthcare delivery assets.

My view – Insourcing primary care, tying it all together with technology, and owning a centralized best-of-breed tertiary care delivery center would allow for vastly better care, lower patient hassle, and cost control. - Buy healthcare on the basis of employee productivity

My view – Healthcare is perhaps the only purchase organizations make where there is no consideration of value – of what they get for their dollars. To the Bezos’, Dimons, and Buffets of the world, this is nonsensical at best. They will push for value-based care, defined as employee productivity. - Build their own generic drug manufacturer

My view – No-brainer. - Allow employees to go to any primary care provider they want, but require them to go to Centers of Excellence for treatment of conditions that are high cost with high outcome variability.

My view – No brainer.

I’d also expect many more large employers will join the coalition, for the simple reason that they have no other choice.

What does this mean for you?

Do not discount this.

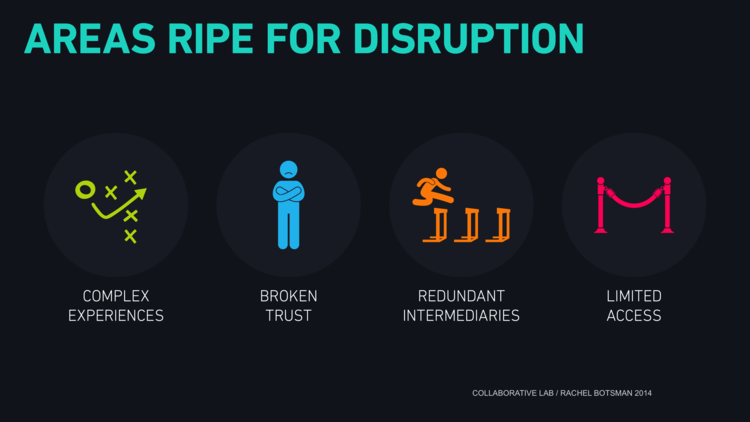

credit Collaborative Lab, Rachel Botsman

credit Collaborative Lab, Rachel Botsman