It’s a hell of a lot easier to blow something up than to build a replacement.

Especially when you don’t care about a replacement.

Fact is, we – you, me, taxpayers, governments – cannot afford our current health care “system.” And it is getting more expensive every day.

Congress and the President are continuing their efforts to weaken and hobble the ACA, and they are generally succeeding. Without enforcement of the individual mandate, fewer young folks are getting insurance, increasing premium for us oldsters. The number of Americans without health insurance is up, health care costs are rising, and future Medicare costs are escalating.

The misguided and ill-intentioned “work for Medicaid” effort is going to create a whole new governmental bureaucracy, raise costs, and have zero positive impact. Medicaid changes are going to lead to hospital closures, especially in rural areas and inner cities.

Health care costs were $3.5 trillion last year – and they’ll top $4 billion in two years. That’s a meaningless figure – until you realize our national and your personal budget is going to get whacked.

But it’s worse than that. The bi-partisan budget deal and tax cuts will exacerbate our already-huge national debt, screwing our kids and grandkids. The biggest driver? Health care.

And Congress’ and the President’s solution is nowhere to be seen.

Where’s the “replacement” the GOP has been talking about? Where’s the “market-based solution” to our health care crisis? Where’s the plan to lower drug costs?

Have you seen anything from Congress or the President that gives you any hope they have any plan?

These politicians aren’t interested in governing, don’t care about your costs or your kids’ debt, and hope you don’t pay attention. They have no political courage, no interest in doing anything that might cost them the next election.

What does this mean for you?

Nothing good.

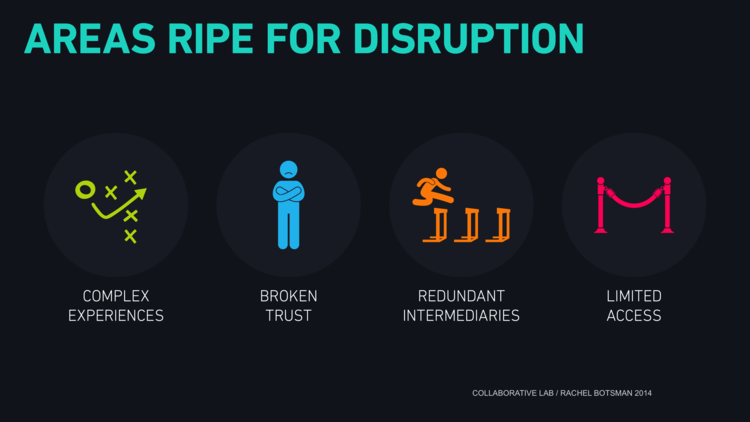

credit Collaborative Lab, Rachel Botsman

credit Collaborative Lab, Rachel Botsman