Lots of really good stuff to end your week…

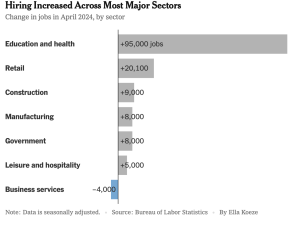

the Economy…

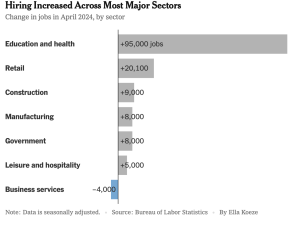

remains quite good with 175,000 new jobs last month. This was not as many in previous months…

BUT it looks increasingly like (From NYT) “the exuberance of the last two years might be settling into a more sustainable rhythm”.

Stock markets jumped (the Dow is up 723 (!!!) points this week), interest rates declined modestly,

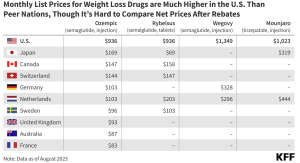

Seniors’ lower drug costs…

Insulin prices are capped at $35 per month, a major reduction from an average of $300…even better, next year President Biden’s Inflation Reduction Act will limit seniors’ out-of-pocket costs for all prescription medications $2,000 per year.

There’s activity in Congress and by the Biden Administration that would limit everyone’s cost – young, old, and in-between – for insulin to no more than $35 a month…here’s hoping the pols get this done.

This means...With diabetes affecting more Americans, improving access to insulin means healthier families and employees, which leads to lower healthcare costs.

More good news…the Medicare Hospital Trust Fund’s financial solvency was extended to 2036, a five year extension. Not to worry, there’s no doubt this will be extended again.

This means…better finances for hospitals and seniors.

Lots more jobs in Wisconsin and…No more noncompetes!

In the “government CAN actually make life better” category, we have…lots of great jobs coming to Wisconsin…AND a ban on non-competes.

Microsoft is building a giant AI Center near Racine, Wisconsin. The city was hit hard by the collapse of the Foxconn deal which promised gazillions of dollars and jobs…but never happened. Supported by the Investing in America project, this brings new investment why private companies in Wisconsin to $5 billion – and counting.

The Federal Trade Commission effectively banned non-competes...thereby freeing you up to…actually control where you want to work.

Non-competes are contractual controls that effectively prohibit employees from working at specific jobs, customers, or companies for a defined period in exchange for a/some defined “benefit(s).”

This is a MAJOR bonus for anyone working today as it allows you – not some corporate entity – to control your life. And, the rule is quite broad, clearly empowering workers.

This from Harvard Business Review…

“Worker” is defined not just as an employee but also includes independent contractors, externs, interns, volunteers, apprentices, or a sole proprietor who provides a service. The rule also broadly defines noncompete clauses not only as terms or conditions of employment that explicitly prohibit a worker from competing with a former employer, but also to mean any other clauses that “penalize a worker for” or “function to prevent a worker from” competing. With this definition, the FTC also prohibits clauses that operate as de facto noncompetes, including overly broad NDAs, nonsolicitation clauses, and TRAPs — training repayment agreement provisions. [Emphasis added]

Have a most excellent weekend!