The older I get, the more I understand the value of experience. (convenient, huh?)

The counter to that is one also learns – often the hard way – that assumptions – usually based on “experience” or “common knowledge” – can be dangerous indeed. Below, a few of the assumptions I’ve held at various times that turned out to be wrong.

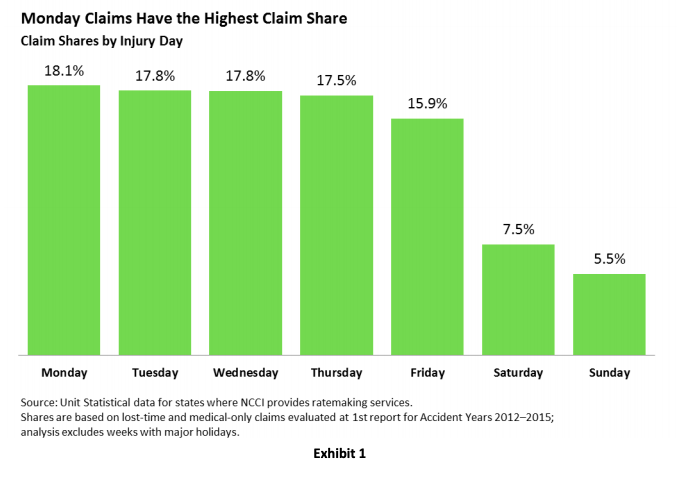

More workers’ comp claims happen on Monday because workers hurt over the weekend wait till Monday to file so they can cheat the system.

Well, if there is a correlation, it is tiny. The NCCI did an excellent study last fall looking at the impact of the ACA on claims, here’s one of the study’s findings.

People without health insurance are more likely to file work comp claims.

Nope. In fact, the best research I’ve found – from RAND – indicates the opposite is true. That is, workers whose employers do NOT provide health insurance are LESS likely to file work comp claims.

This may be due to the employer-employee relationship; employees who perceive their bosses to be more benevolent may be more likely to file claims as they don’t think they will suffer retaliation.

People always act in their own self-interest.

This one is a bit more complicated. Generally, it is true – the key is how one defines “self-interest” – external entities can often convince people to act against what is their true self-interest via effective messaging. Poor white farmers joining the Confederate military to preserve a system that kept them desperately poor is one striking example; the anti-vaxxer campaign is another.

What does this mean for you?

Be ready to give up long-held beliefs in the face of solid evidence. It’s Ok to admit you’re wrong.

Apologies for my absence this week – getting back in action after dealing with the flu for a few days. I’m a lousy patient, as my long-suffering bride will attest.