It’s happening sooner than expected…a new entrant into the workers’ comp insurance business (following other P&C lines by companies including Omnius) is pursuing regulatory approval for and licensure of an “AIdjuster”.

Notably this goes far beyond current thinking, described in a recent Risk and Insurance piece as:

By reducing administrative workloads, AI can give claims adjusters more time to spend with injured workers.

This is replacing adjusters with technology, technology that will:

- interact (both verbally and electronically) with providers, injured workers, and employers;

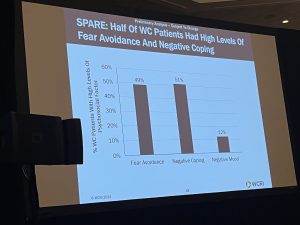

- constantly evaluate those interactions to identify red flags or barriers to progress;

- better estimate future costs, duration, reserves, and return to functionality;

- leverage provider data to identify potential abuse or overuse;

- constantly update the worker’s profile and compare it to job requirements (from past job to transitional jobs to potential new employment)

There’s a raft of complications with one of the most obvious being state requirements for human licensure. I spoke with the company’s Chief Claims Officer, Aprille Pfuehle PhD. Dr Pfuehle noted:

There’s a raft of complications with one of the most obvious being state requirements for human licensure. This can easily be addressed by having a human adjuster “oversee” the AIdjuster’s work…We are also working on logic to insert a human adjuster into claims issues based on our algorithm’s determination that a human intervention is optimal…

While it seems pretty sudden, reality is many industry stakeholders have been working towards this for some time.

But…Color me skeptical...there is so much nuance to the job, experience is critical, human interaction essential, and empathy critical…that and AI is still awfully new, risky, and more than a bit weird.

Yet…the factors driving the “AIdjuster” may outweigh those needs. When I asked how they were expecting widespread adoption, Dr. Pfuehle seemed quite confident, alluding to the staffing challenges facing insurers and TPAs;

- an aging workforce;

- lack of training;

- a talent war accelerating turnover;

- lots of other opportunities for potential new hires;

- a difficult, trying, and sometimes quite frustrating work environment; and

- increasing labor costs while premiums are shrinking.

Pfuehle also opined that the P&C industry’s chronic under-investment in IT all-but ensured their venture would succeed, stating:

They just don’t have the financial or talent resources to do what has to be done (building AI capabilities)…our solution eliminates the need for massive investment with an uncertain result, while allowing insurers to greatly improve their financials by eliminating much of their administrative costs...

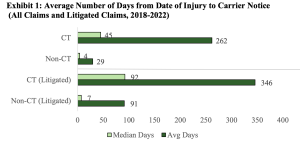

The implications are broad indeed; In conversations with claim execs, the adjuster shortage is one of the factors driving insurers to outsource claims to TPAs…lack of training is another major obstacle, rising labor costs yet another and both contribute to a lack of consistency in claims handling.

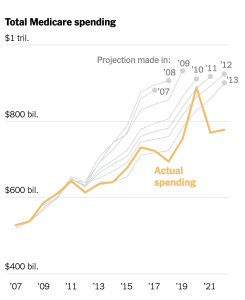

That and WC profits are desperately needed to fund losses in most other lines...and thus can’t be invested in tech.

What does this mean for you?

What’s fantasy today is reality tomorrow.