I’m hearing more complaints and concerns about the lack of results from projects involving “big data”, analytics, predictive modeling and the like. These have me scratching my head, as effective use of data is critical to any enterprise these days.

I think I’ve figured out why some of these projects haven’t turned out the way sponsors want.

An excellent article on the effective use of analytics identifies 6 keys to ensuring success hit my inbox a bit ago and I’ve read it seveal times, passed it on to respected colleagues, and gotten their feedback.

Targets and accountability. The Central Analytics Business Unit (ABU) was set up as a centralized profit center with ambitious targets and with direct reporting to the chief operations officer;

Support from the top. Obvious, critical, and bearing repeating.

Incentive scheme alignment. The returns generated by ABU’s analytics projects accrue to the departments, who do not contribute to the cost of the ABU. And the ABU team is paid using variable compensation, based on projects that have been fully implemented and based on their ROI.

Rigorous assessment of results. The contribution of analytics is always measured and in some cases is reviewed by the accounting department.

Communicating with strategic goals in mind. The ABU emphasized communication

The right people. Recruited employees had:

(1) significant quantitative strength;

(2) negotiating skills and diplomacy;

(3) the ability to communicate with the business lines; and

(4) entrepreneurial instincts. Recruiting this high-demand skill set was not easy.

Most of the initial ABU recruits were external hires, and several of them had little knowledge of the banking industry.

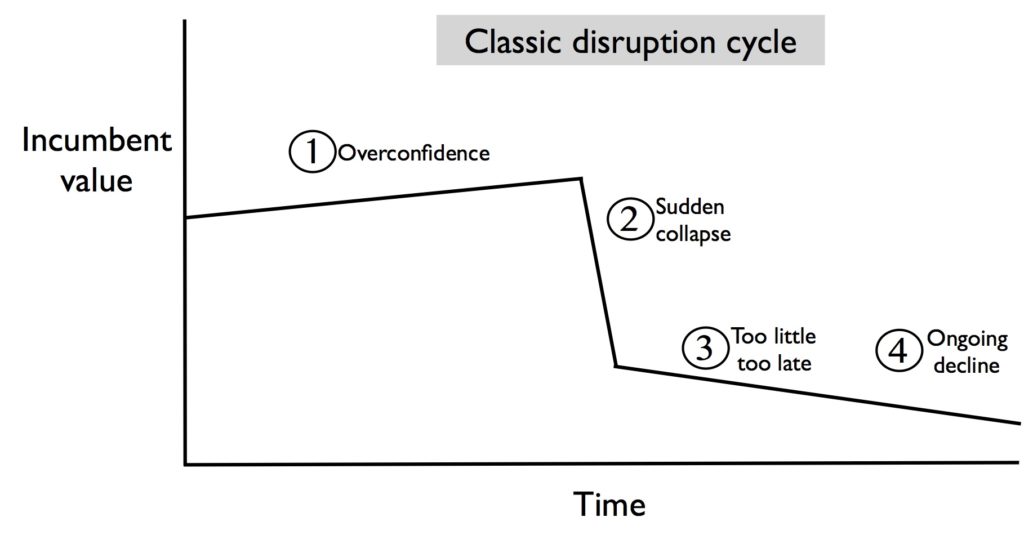

BUT…information without action is nothing but a waste of time and money.

This from a physician executive colleague:

One of the things they don’t discuss that I see as an issue throughout the insurance industry (commercial as well as WC) is that analytics often produce counter-intuitive results, and/or suggest conclusions that are at odds with what passes for traditional wisdom.

An example – I had 3 years of analytics (pretty good ones, too) that demonstrated a 5 or 6:1 ROI from the medical directors’ department (and that included all costs, fully loaded salaries, etc). No one would believe it, and they dismantled the whole operation. So, what I’d add to the HBR piece is that the CEO championing (which is one of their 6) has to include championing of business plans based on the analytics, no matter how uncomfortable that makes some people.

Think analysis of the true costs of network discount strategies is going to be well received anywhere?