Workers comp is:

a) hugely profitable,

b) way over-priced,

c) even more profitable than it looks,

d) by far the most profitable P&C insurance line,

e) NOT suffering from medical cost increases,

f) a highly mature industry with all the attributes thereof,

g) shrinking as claim frequency continues the 20-year trend averaging -3.4%

h) the financial savior of multi-line carriers, and/or

i) all of the above.

The answer is…i.

NCCI’s Annual Issues Symposium provided a deep dive into the industry’s financials…and the industry is swimming in a lake of profits.

With a net combined ratio of 86%, WC is HUGELY profitable…especially when one considers the industry is over-reserved to the tune of…$18 BILLION.ut wait…when you add investment income, private carriers pre-tax operating profits are a whopping 23%.

Which means premiums are still far too high, employers are still paying far too much for WC insurance, and insurers are sitting on $18 billion that should be returned to policyholders.

This despite ongoing premium rate reductions…in every state.

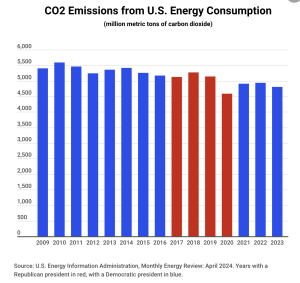

Oh, and medical inflation is LESS than overall inflation – at a paltry 2%.

Amidst all this sunshine and rainbows, there’s one troubling trend…facility costs.

Specifically ASCs and outpatient, which is the only category showing an increase in share of medical spend.

As CompPharma has reported drug spend has been trending down for years – and now accounts for just 7% of total WC medical spend – down from 12% in 2012.

The full AIS report is here …

What does this mean for you?

Employers – lower rates – MUCH lower rates.

And BIG dividends if your carrier is a mutual.

Insurers – invest those profits in technology NOW. Workers’ comp – and the P&C industry as a whole – is waaaay behind in tech. NOW is the time to invest – because…

this will not last.