A just-published research study examined the impact of reductions in opioids on workers’ comp patients and prescribers in Ohio and Washington.

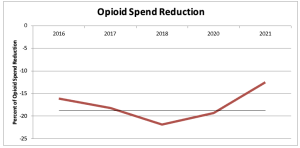

(our research which includes payers’ opioid spend is here)

Key takeaways:

- Providers reported more limited and cautious prescribing than in the past

- Both patients and providers reported collaborative pain-management relationships and satisfactory pain control for patients.

- Despite the fears articulated by pharmaceutical companies and patient advocates, opioid review programs have not generally resulted in:

- unmanaged pain or reduced function in patients,

- anger or resistance from patients or providers, or

- damage to patient–provider relationships or clinical autonomy.

- Other insurance providers with broad physician networks may want to consider similar quality-improvement efforts to support safe opioid prescribing.

From Milbank Quarterly:

The data analyzed in this study were a subset of data collected within a larger parent project—a comparative effectiveness study of the WC agency ORPs [opioid reduction programs] implemented in WA and OH.

I’d note that some Ohio patients and providers surveyed had real and significant challenges with access to care, approvals and care management. The report noted:

The fact that some of the problems described above seem to be particularly acute in OH could be a result of the fact that most WC claims in OH are handled by MCOs, whereas in WA, claims are processed directly by the L&I. The uniquely negative experiences of patients and providers navigating injuries and pain management in OH could be because of MCO dynamics, such as staffing challenges, management issues, or other operational problems. In addition, some MCOs are for-profit companies, which may render them more likely to deny expensive medications, procedures, or consultations.

Note – I was a member of the Advisory Committee for this research project; it was funded by the Patient-Centered Outcomes Research Institute.

What does this mean for you?

Overall, efforts to reduce inappropriate opioid use have been:

- effective,

- helpful in getting patients and providers to collaborate, and

- have not resulted in unmanaged pain.