To know why some think the US healthcare system is going to get better and cheaper – and why I strongly disagree, read on.

David Cutler PhD led off the WCRI’s confab with a discussion of the future of healthcare. It was GREAT that a conference has finally tried to educate work comp people about healthcare – after all that is the biggest driver of workers’ comp. Sorely needed.

But…(more on that in a minute)

Dr Cutler noted that US healthcare is about as unstable as it has been for some time. And there is much more uncertainty to come.

He then asked the audience to vote on whether healthcare will get better and cheaper, stay the same, or collapse.

I voted collapse.

He also differentiated between “Trend” and “Wiggle”, noting it is important to consider what is actually a trend vs what is more likely slight ups and downs – need to differentiate between one-time factors and overall structural issues with long-lasting implications.

Cutler attributes consolidation among small providers to the drop off in patient service demand; that is, demand for providers’ services declined and therefore the smaller providers needed to merge or be acquired. I’d note that Cutler did not mention other factors driving consolidation, namely:

- Interoperability (CMS IT requirements that can be a big lift)

- small office staffing woes,

- office operational expense increases, and

- PE buyouts that make owners wealthy overnight.

Why Cutler is positive about the future of the US healthcare system

- Delivery of medical care (number of services rendered) fell off during covid and really hasn’t fully recovered, which implies there are fewer unnecessary procedures/visits/treatments these days. (assumes the decline was mostly in unneeded services)

- Elective stuff didn’t come back – such as hip replacements, shoulder surgery, etc.

- Staff shortages are less of an issue of late

Dr Cutler also noted that in his view, medical staff burnout and labor force withdrawal from healthcare delivery roles will be temporary…Employment is coming back.

Very briefly, Dr Cutler’s thinking is that hospitals have too many beds; a lot of care has moved to outpatient facilities and ambulatory surgical centers (ASCs)…as a result hospitals will close floors, other hospitals will close, and the need for nurses in hospitals will thus decline.

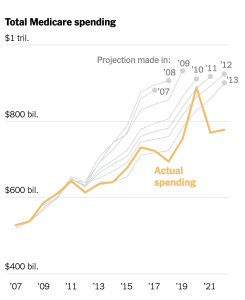

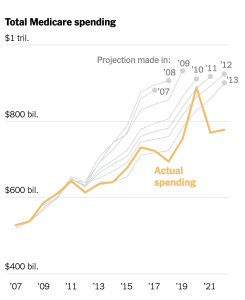

Notably, Dr Cutler provided data from CMS to build a case that healthcare itself is better controlled – Medicare growth has been relatively flat over the last few years, and some analysts believe this has reduced total spend by several trillion dollars.

Finally, Dr Cutler also discussed value-based care and the move to bundled care, I suppose as evidence that healthcare is getting more efficient.

So here’s the “But…” in which I respectfully disagreed – and and still do disagree – with Cutler’s optimistic outlook.

Cutler – Shift of care away from and hospital closures will reduce costs and staffing needs

MCM – I don’t have the data, and I’m sure Dr Cutler does, but there’s both anecdotal “evidence” (family members have left patient care for other jobs in healthcare) and actual research that clinical staff shortages are NOT moderating.

Here’s rather compelling evidence that the shortage is NOT going away.

According to the United States Registered Nurse Workforce Report Card and Shortage Forecast published in the September/October 2019 issue of the American Journal of Medical Quality, a shortage of registered nurses is projected to spread across the country through 2030. In this state-by-state analysis, the authors forecast a significant RN shortage in 30 states with the most intense shortage in the Western region of the U.S.

Perhaps Dr Cutler is talking over the very long term – and perhaps the Journal’s authors are not accounting for the shift in care to outpatient facilities.

Perhaps. On the other hand, change is very, very slow in healthcare.

Also, hospitals are major assets, assets which are providing a ton of revenue to the health system or hospital’s owners. Sure, many owners might like to walk away…but they can’t – not without huge pressure from unions, workers, communities and politicians. So, they’ll do anything they can to keep the patients coming, to keep the hospital open – if they don’t they will go belly up – oh and some of the hospital’s execs will not have jobs.

Cutler – Value-based care is saving money…

MCM – There is very little evidence that VBC actually saves money, and a lot of evidence that it doesn’t. In fact, a CBO study indicates that overall, well-funded, well-designed and well-run VBC initiatives actually resulted in higher costs. I’d note that some disagree with CBO’s results. – however those disagreements generally focus around better outcomes, health indicators and the like – NOT on cost reductions.

Cutler – Medicare spending is below predictions thus healthcare is less costly

MCM – But other payer spend has not.

Yes, Medicare’s costs have been below predictions…but that’s NOT the case for individual insurance, group health and Medicaid spend – which has has increased.

To be fair, Cutler agreed with my comment (which I made after his talk), but noted Medicaid spend per enrollee has declined.

He is correct…however in my view but likely because the expansion of Medicaid involved more healthier people being signed up before and during the COVID emergency. And, their costs prior to enrollment were likely uncompensated care…so my take is overall medical costs weren’t reduced, just shifted to a different payer.

At least for the next few years – and likely longer – the “shiftee”, dear reader, is often workers’ comp.

Finally, good friend and colleague Gary Anderberg PhD of Gallagher Bassett commented that all of us are getting older and sicker and how does that factor into predictions re cost. Cutler indicated he sees it as a mixed picture as cognitive and CV health are improving while others – obesity-related such as diabetes in particular – are declining.

What does this mean for you?

I still vote collapse.