Here’s a quick-albeit-still-somewhat-up-in-in-the-air take on how the midterms may/will impact healthcare. Much depends on final results in several key elections (Senate in GA, NV, :

Medicare and Medicaid

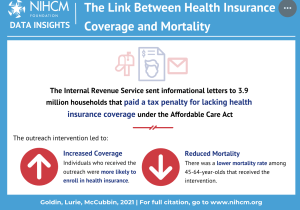

Drug prices – Biden’s Inflation Reduction Act will reduce seniors’ drug prices; if the GOP takes control of the House (which appears likely) it may try to hold up/block/hinder Medicare drug price negotiation through oversight on how HHS implements the new policy.

If Dems hold onto the House (which is highly doubtful), we can expect legislation that would expand Medicare and Medicaid.

South Dakotans voted to expand Medicaid; this is a big win for rural hospitals and the uninsured – 40,000+ South Dakotans will now have access to health care. For South Dakotans, the impact – healthier people and financially healthier hospitals = healthier economy.

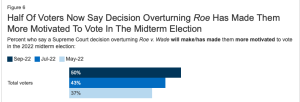

Abortion rights

Ballot measures in 5 states addressed abortion rights with voters in California, Vermont, Michigan, and Kentucky (!) passing measures to protect women’s right to choose; as of early this morning no word on Montana. Note there are nuances specific to each state; CA MI and VT’s votes enshrined a right to an abortion in their respective state Constitutions while KY defeated a measure that would have explicitly stated nothing in the state’s Constitution creates a right to abortion.

impact – while the votes in CA and VT were no surprise, MI was less certain and KY’s result is notable indeed; Kentucky joins Kansas as another relatively red state whose voters protected abortion rights.

These wins may well drive anti-abortion candidates and politicians to re-think their stance or risk voter backlash.

Investigations, oversight, and the like

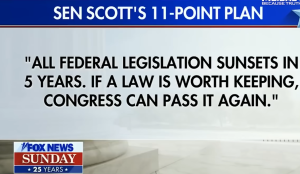

If Republicans gain control in the House (likely) and/or Senate (maybe/maybe not) expect a raft of investigations into all manner of Medicare, Medicaid, COVID response, drug pricing and other issues real and imagined.

The biggest thing no one is talking about

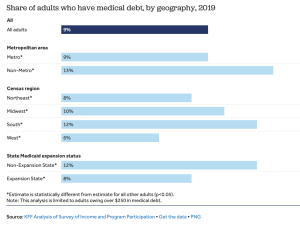

Voters in Arizona overwhelmingly backed a measure intended to protect people from medical debt collections and collectors.

From the Arizona Mirror:

Prop. 209 would reduce the maximum interest rates that could be collected from 10% to 3% annually. Currently, up to 25% of wages can be garnished by creditors, but Prop. 209 would limit that to just 10%. Courts would also be allowed to reduce the amounts being garnished in cases of extreme economic hardship, a power they don’t currently have.

I fully expect activists in other states to jump on this; it is hugely popular and desperately needed.

What does this mean for you?

Watch the updated results to see what happens with the House and Senate. That will drive what really happens…