2017 will be a very misleading year.

There will be no changes to health reform, markets, Exchanges, Medicaid, or Medicare. More people will be insured, hospitals and health systems will enjoy financial stability, and while losses in the individual market for the big five insurers will increase somewhat, work comp will prosper.

This will lead some to think everything’s fine, there’s nothing to worry about, it’s all good, I and others worrying about health care’s future are hysterical Chicken Littles.

Let’s summarize. There are two general scenarios; GOP repeals ACA’s main components without addressing system-wide fallout, or GOP essentially re-brands ACA (TrumpCare, anyone?) leaving much of the current ACA in place.

If the GOP repeals ACA via reconciliation and/or without:

- replacing it with an enforceable mandate,

- maintaining changes to Medicare fee schedules and reimbursement,

- maintaining the Medicaid expansion,

- maintaining cost-sharing subsidies for the near-poor, and

- restoring DSH and other supplemental hospital/health system funding.

This is what we’ll get.

- The individual market collapses as insurers exit Exchanges

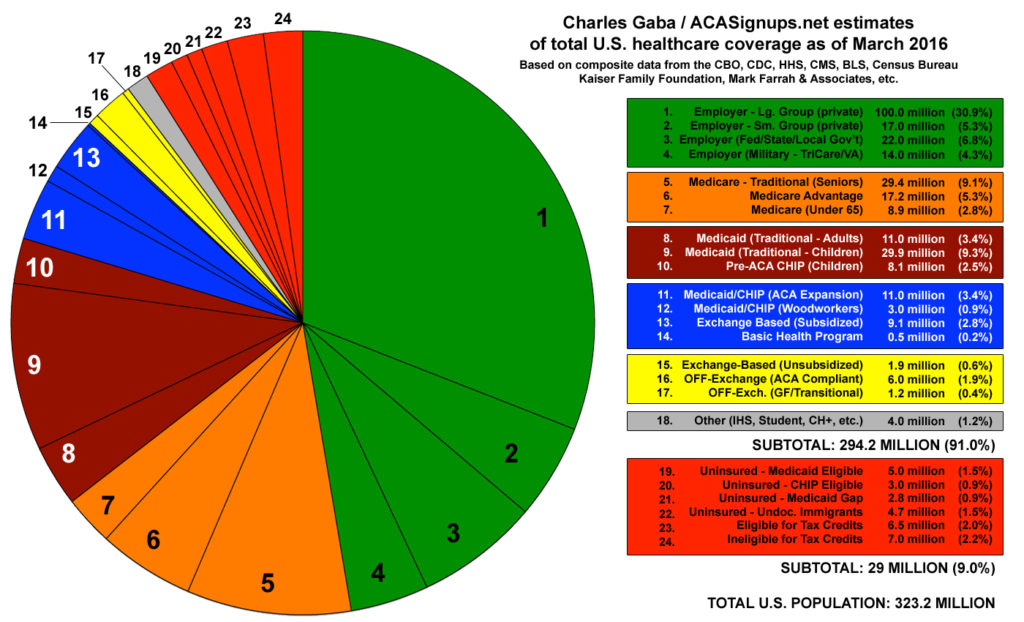

- The number of Americans without health insurance increases by roughly 30 million by 2019

- Hospital and health system revenues drop while indigent care costs and bad debt increase significantly

Implications are obvious;

- cost-shifting to private insurance, workers’ comp, and other property and casualty insurance increases

- claim shifting increases

- job lock increases as people don’t leave their employer for fear they won’t be able to get or afford health insurance

- individual bankruptcy rates increase

I must admit to a morbid fascination with the game that’s playing out. I’m both embarrassed to admit that fascination and appalled by the damage that will be done to people, businesses, cities and states by the combined ideology and ignorance of our newly-elected House, Senate, and President.

As friends and colleagues keep telling me, we don’t KNOW what these worthies will do.

True, but we can read policy papers, previous proposed legislation, and statements of incoming officials, all of which point to dramatic changes to healthcare. This may well not happen, as those now in positions of power may decide ACA isn’t so bad after all.

Their constituents have certainly changed their tune, with barely half of the Republicans surveyed looking to repeal “Obamacare”. Then again, many didn’t know that “Obamacare” and ACA are one and the same.

I don’t think the “repeal and destroy” scenario indicated by those papers and statements will happen, because the real-world impacts would be so damaging. It appears most on the Hill are leaning towards leaving much of ACA alone, tweaking around the edges, declaring victory and moving on.

Then again, I didn’t think Donald Trump would be President.

If the “tweak and rebrand” strategy wins out, there’s still an awful lot of uncertainty. The healthcare “system” is a Rube Goldberg contraption like the one where you hit one button and out pops a dollar bill, but if you hit that button while holding down the shift key, you get punched in the face.

What does this mean for you?

Yes, this is really complicated and sometimes hard to unpack. Don’t fall into the trap of willfully ignoring what’s going on in healthcare, as the implications for you and your business are huge indeed.