There’s been some good research into this – which may be THE key question when it comes to medical marijuana.

The answer appears to be – some do stop using other drugs. And, even better, fewer people die.

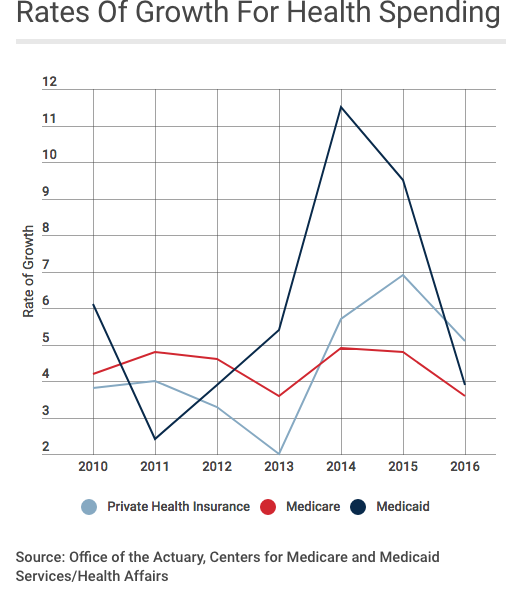

Key findings using Medicare data:

- States with medical marijuana laws saw about 10% fewer daily doses of opioids than those without those laws.

- States with dispensaries only (no home cultivation) saw a 14% decrease in opioid doses

- Total savings to Medicare and Medicaid would be about $3.4 billion if all states adopted Medical Marijuana Laws – but the folks buying the marijuana would pay for their cannabis out of their own pockets.

Studies using Medicaid data saw somewhat greater reductions in opioid usage.

Couple observations – there have been massive changes in PDMPs, increases in naloxone usage, tighter state laws and federal guidance on opioids (CDC et al), which may well have had some impact on death rates and lower opioid usage overall (Brian Allen of Mitchell made this point just after I wrote this). Dr Bradford noted that their analysis considered these possible confounding issues.

My big takeaway – there’s a significant reduction in the number of deaths due to opioids when states have access to cannabis. Like a 25% reduction.

Dr David Bradford of the University of Georgia presented this information; he and Ashley Bradford published much of this in a piece in HealthAffairs two years ago; they used Medicare and Medicaid data.

Dr Bradford noted he and Ms Bradford hope to be working with WCRI on a workers’ comp-specific study soon.