With payrolls plummeting and premium dollars poised to follow suit, workers’ comp payers are looking for the proverbial nickels in the couch cushions.

While pharmacy costs have been declining for years, there are several ways payers are losing money by overpaying for drugs.

Here’s one.

Almost all work comp payers pay for drugs based on a discount below AWP. Generics get a much deeper discount than brands, perhaps 45%+ compared to 13% or so. That being the case, you’re getting a much better price on all your generic meds.

Well, perhaps.

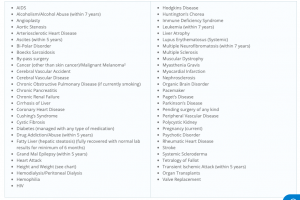

First, what is a generic? Again, seems straightforward, but thru the miracle of legalese, it can be anything but. I’ve seen many a PBM-Payer contract where the definition of generic was, well, opaque.

there’s a definition in there somewhere…

A “generic” is a generic… right…?

Well, no. Among the generic definitions I’ve seen are:

- a generic drug is a medication the contains the same chemical substance as a drug that was originally protected by, and is no longer protected by, chemical patents.

- a generic drug is a medication listed as a generic by a compendia (such as Medispan’s GPI, or generic product identifier)

- a generic drug is a medication with an “O” or “Y” identifier

- a generic drug is a medication available from multiple manufacturers

And, that definition was buried in the dense print on page XXX, while the pricing referring to generics was somewhere else, and the process and timing of linking the two, and the data source for the actual prices were either nowhere in the contract or buried somewhere else.

Unless you a) know exactly and precisely what the definition should be; b) read and understand the entire contract so you can connect a definition to a pricing level to a pricing basis/compendia/source; c) have the expertise, staff, resources, and time to monitor the actual pricing you are getting, you don’t KNOW if you are overpaying for “generics”.

What does this mean for you?

Do you know what you don’t know?