A dozen years ago, there were lots of relatively small companies delivering specific services to work comp payers.

There were 10 PBMs. 5 bill review application and more diagnostic imaging vendors. Dozens of case management companies. Scores of IME firms. The same for DME, home health, transportation/translation, and UR. Lots more TPAs too.

Today’s landscape is dramatically different.

3 PBMs have significant market share.

Conduent is the largest BR app provider, with Mitchell second and Medata gaining share; their competitors were acquired.

There’s one major dx imaging firm.

A dominant IME company.

There’s been vertical consolidation (think Examworks rolling up the IME business) and horizontal mergers (One Call buying PT, DME, home health, dental and T&T companies; Paradigm buying case management, network, and niche service firms, Mitchell/Genex doing the same).

Sure, there are smaller companies, many of which are flourishing – think HomeCare Connect, MTI America and Carisk (the latter two are HSA consulting clients). There are much larger ones – think MedRisk (HSA consulting client) – that focus on a single service. These companies identified a niche, and/or developed a unique capability and/or deliver exemplary service – simple in concept, brutally hard in execution.

What’s happening in the workers’ comp service industry shouldn’t be a surprise to anyone with a lick of business sense; comp is a shrinking business, with flat medical costs and fewer claims every year.

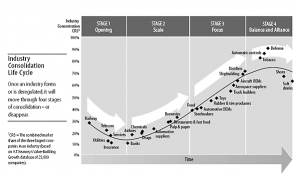

For an excellent summary, read this Harvard Business Review article.

Point being there are two distinct ways to survive and even thrive in a rapidly consolidating industry – get big, get efficient, lower costs – or focus narrowly and/or deliver exemplary service.

In either case, a relentless focus on identifying and solving customers’ problems will determine if you live or die.

Both models have big issues and challenges;

- cybersecurity is a huge challenge for small companies with limited resources;

- efficiency does not and cannot mean lowering customer service standards; and

- buyers (managed care and claims execs) value different things than front line workers – but you have to please both.

What does this mean for you?

If you’re wondering where you will be in a few years, wonder no more. There will be fewer service companies delivering fewer services to a smaller group of ever more demanding payers.

Same applies to TPA services. Not only is the claim volume shrinking but the number of entities who go the high deductible or self-insured route for worker’s compensation coverage is decreasing. Go big or find a niche/deliver exemplary service. Challenging time to be a service provider to the worker’s compensation industry.

well said Jonathan. TPAs are also service entities; thanks for bringing that to readers’ attention.