Consumers don’t care.

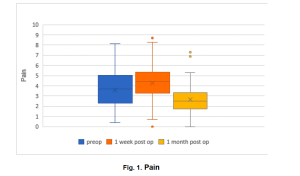

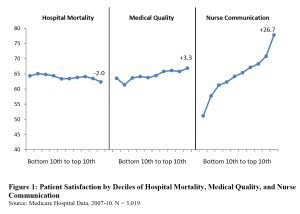

Yesterday we dove into the disconnect between patient satisfaction (my nurse was sooo nice and my room…wow!) and quality of care (how likely was I to die).

Today, we focus on how this affects our healthcare. Or, as the researchers put it;

In an era of management by satisfaction survey, how does hospital competition shape the kind of medical services offered to patients?

Leaving out the coefficients, standardized deviations, null estimates and other researchers’ esoterica, we find:

Local competition among hospitals leads to higher patient satisfaction, but lower medical quality.

Yep, because we consumers value quiet rooms and nice nurses more than surviving an operation, health care facilities seem to focus more on quietness and niceness than on, you know, patients actually surviving.

And that’s because hospitals are competing desperately for private-pay patients, the ones insured by employers that pay three times more than Medicare. As the authors put it;

as a business strategy, investing in hospitality and hotel amenities offers a much higher return than medical quality.

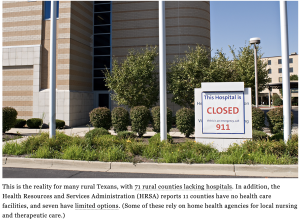

this research speaks to broad concerns about the unintended consequences of marketization…Hospitals have traditionally been conceived as an essential service to a community, but are becoming more like products in a consumer marketplace.

Those working in hospitals are increasingly expected to focus on the pursuit of customer satisfaction.

The day-to-day institutional question is shifting from “will this improve patient health?” to “will this raise satisfaction scores?”

What does this mean for you?

Depends… life > comfort?