MedRisk and Medata just announced the former has acquired the latter.

Pretty interesting move…note I’ve worked with Medata in the past and worked with Medrisk for decades – and still do.

The official release is below – here’s my take.

Synergies

Data – Medata has a wealth of data on all types of medical services; MedRisk has data on millions of (physical medicine) episodes of care. Together, there are several potential benefits:

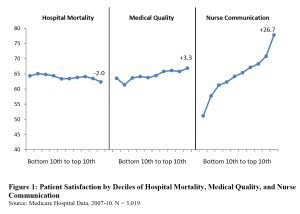

- More information is good, helping identify best practices and providers with – and without – good outcomes. This will help improve patient outcomes.

- Medata has data on post-PT costs, medical care, provider usage and other very useful information. This will help MedRisk better understand care delivered after a therapy episode and identify opportunities to improve return to work, transitional duty practices, and issues that may arise post therapy.

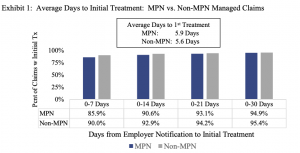

- Network development – Medata has a wealth of information spanning decades on physical therapy, occupational therapy, and chiropractic services’ prices, reimbursement, utilization and trends. These data will further help improve MedRisk’s network and enable it to provide better information re provider performance in- vs out-of-network.

- These benefits will be felt soonest by mutual customers, but over time will improve results for each company’s unique customer base.

Efficiency

MedRisk is the largest manager of physical medicine in work comp and does a LOT of bill review in that space. Now that it owns a BR company, BR costs should decrease, improving margins albeit it on the margin.

With bill information coming into Medata, MedRisk will be better able to identify out-of-network therapy and where possible and appropriate either enroll the therapist if credentialing approves or divert the patient to an in-network therapist. This will improve patient outcomes, increase payers’ network penetration and likely reduce cost of care.

Here’s the press release…

MedRisk acquires Medata to further improve the claims experience for customers, patients, and providers

King of Prussia, Pa. (January 9, 2024) — MedRisk, the leader in managed physical rehabilitation in workers’ compensation, has announced its acquisition of Medata, one of the leading providers of cost management and clinical solutions in the United States.

With this acquisition, customers of both companies will have access to expanded care management and cost containment offerings in workers’ compensation.

“We are excited to add Medata to our team,” said Sri Sridharan, MedRisk CEO. “This will further enable us to deliver superior claims outcomes and experience for our customers, for the patients we serve every day, and for our provider partners. In addition, we will now be able to leverage our inventory of data from both organizations so we can deliver unique insights and additional innovative solutions.”

Based in Irvine, California, Medata provides the most comprehensive cost containment and document management solutions in the workers’ compensation and auto liability industries.

“We are thrilled to become part of MedRisk,” said Medata President Tom Herndon. “Our companies recognize customers want greater alignment among their service partners, and this change strengthens our foundation and will drive investment into product innovation. Together, we will leverage our collective resources to continue delivering exceptional products and services to our customers.”

“For 30 years MedRisk has focused on creating a better experience for patients, our customers, and the entire industry,” said Mike Ryan, MedRisk Executive Chairman. “The addition of Medata is a natural and exciting step forward for us to further accomplish that mission.”

About MedRisk

Based in King of Prussia, Pennsylvania, MedRisk is the nation’s largest managed care organization dedicated to the physical rehabilitation of workers’ compensation patients. For more information, please visit www.medrisknet.com or call 800-225-9675.

About Medata

Based in Irvine, California, Medata provides the most comprehensive cost containment and document management software and solutions for the insurance industry. The company serves insurance carriers, self-insured companies, third-party administrators, state funds, and public entities in the workers’ compensation and auto liability industries. For more information, please visit www.medata.com or call 800-854-7591.

# # #

Media Contact: Helen King Patterson, King Knight Communications, 813-690-4787, helen@kingknight.com