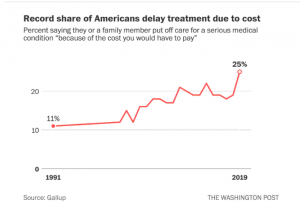

You can’t afford other stuff because healthcare is so expensive. Would Single Payer/Medicare for All fix that?

I’m revisiting the topic so we can better understand the many variations of SP/MFA, how they are different, how those variations might work, and whether some version is a) politically viable and b) would solve the cost/access/quality conundrum.

Last week I made the case that voters want healthcare solved, and they don’t much care about the details and nuance. We also showed that employer-sponsored health insurance is a mess.

Can private insurers solve the healthcare cost problem? Well, on one level they get dinged if they control costs. A key point about for-profit insurers – the stock market loves and rewards revenue growth. In health insurance, revenue growth is overwhelmingly driven by higher medical costs. So, medical cost inflation = higher revenues = higher stock prices (yes, this is simplistic, but also mostly true).

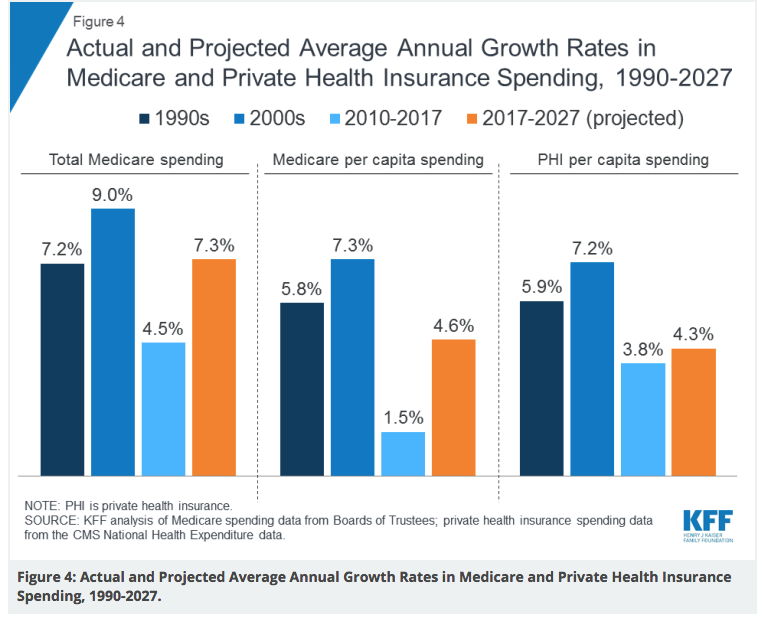

Over the last two years insurers have kept premium increases low, but that’s due in large part to cost-shifting to members. In contrast, Medicare can’t cut costs by shifting them to you – benefits are set by law and rarely change significantly.

As we’ve noted previously, facility prices are the biggest driver of cost inflation – and that’s where Medicare outperforms commercial payers. Of course commercial payers will say that’s because Medicare can force payers to agree to its prices – which, although true, begs the question – why can’t commercial payers do the same?

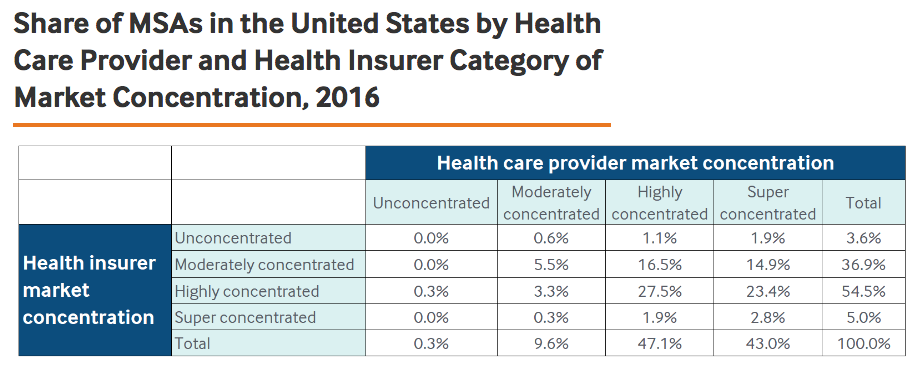

One main reason – in many areas, provider consolidation has given health systems market power – health providers have more leverage so they have an advantage in negotiations.

But – in over half of the markets, insurers are highly concentrated – which means they have significant market power.

Reality is health insurers have failed to control members’ healthcare costs. There are lots of reasons – including provider market consolidation, but as one of my rowing coaches once said to me; “I don’t want to hear why you can’t, I want to hear how you will”.

What does this mean for you?

If for-profit health insurers had done their job – controlling costs and delivering better outcomes and patient satisfaction – you wouldn’t be reading this.

Medicare has a better track record controlling cost – which is by far the most important issue in healthcare.

Stick with me here. The President doesn’t know the difference between tax policy (deductibility) and healthcare benefit design (deductibles). Unless, of course, he was referring to the deductibility of health insurance premiums, which many think is “ridiculously high”. Except, of course, Trump wasn’t.

Stick with me here. The President doesn’t know the difference between tax policy (deductibility) and healthcare benefit design (deductibles). Unless, of course, he was referring to the deductibility of health insurance premiums, which many think is “ridiculously high”. Except, of course, Trump wasn’t.