In the ever-changing world of healthcare economics, one thing is becoming more of a norm – high hospital costs. Crazy facility fees coupled with hospital/health system consolidation are leading to higher prices for payers.

Facility fees, viewed by some as the latest gimmick to generate additional revenue for hospitals, are accounting for upwards of 40% of countrywide workers comp medical expenses.

Making matters worse is hospital/health system consolidation. Consolidation often leads to higher prices – The Federal Trade Commission’s Director of the Bureau of Economics said that hospital have been seen to raise prices as much as 40-50%. Consolidation/M&A took a bit of a pause during COVID but has reemerged and is expected to keep going due to financial pressures and desire to gobble up market share.

Workers’ comp is already vulnerable due to its inability to rival group health’s scale along with unfavorable regulatory dynamics…

As the smallest payer in healthcare, it is critical for WC payers to make sure they are utilizing high quality facilities with reasonable costs.

Consider the following example:

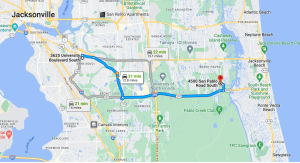

In Jacksonville, Fl:

Two facilities. 21 minutes apart, same side of the city center, but different profiles. The Mayo Clinic – widely regarded as one of the best hospital systems in the world vs. an HCA hospital – Florida Memorial Hospital.

According to Health Strategy Associates’ proprietary Facility Assessment Tool ©, the Mayo Clinic scores the same on Patient Safety, but much higher on Clinical Outcomes, Person Satisfaction, and Efficiency all while being SIGNIFICANTLY less expensive than nearby Florida Memorial Hospital.

*Higher the grade the better*

Using on data provided by CMS and state entities and HSA’s proprietary algorithm to best reflect the medical treatment of worker’s comp injuries, the Tool enables adjusters and case managers to ensure patients avoid poor quality facilities and employers pay a fair price for excellent care.

For a demonstration of the Facility Assessment Tool, email JStithATHealthStrategyAssocDOTcom.