Medicare will negotiate drug prices, Big pharma’s really upset…AARP is really happy…what’s the REAL story?

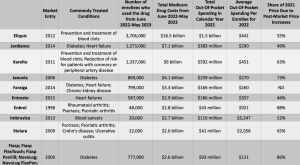

Briefly…One of the key parts of the Inflation Reduction Act authorized Medicare to negotiate drug prices for 10 medications. Those 10 meds have been identified, and the howls of protest from big pharma are deafening…but our profits!!!!!

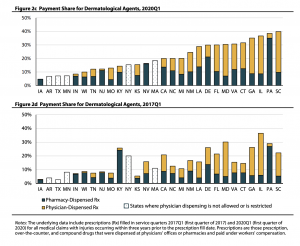

chart credit arsTechnica

(Pharma is the most profitable sector in the economy with a gross profit margin double that of non-pharma companies)

Implications…

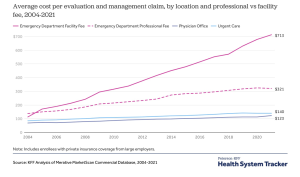

for taxpayers, Congressional Budget Office (CBO) reports taxpayers will save $160 billion by reducing how much Medicare pays for drugs

for millions of Medicare recipients, drug prices and out of pocket expenses for those 10 drugs will drop by thousands of dollars…seniors currently pay up to $6,497 in out-of-pocket costs per year for these meds.

(due to the Inflation Reduction Act, starting in 2025 Medicare beneficiaries’ annual out of pocket drug costs will be capped at $2000)

for payers, the picture is pretty very complicated...netting it out, “these steps would lead to a higher MFP [maximum fair price] and less or no impact on the drug’s…commercial net prices [after rebates]…” [emphasis added]

lest you feel sorry for big pharma, you should know that the ten medications are “older drugs and drugs that have really been blockbusters in the Medicare program. So the companies that have made these products have really reaped handsome profits from those drugs for many years, before they’re even eligible for negotiation.” cite

oh, and about Pharma’s complaint that this will hamper innovation, experts disagree…overall changes to Medicare’s Part D drug program “will probably have a positive impact on drug innovation, especially in areas that address the unmet health needs of high-cost Medicare beneficiaries”