I’m no economist. But I get math.

And so does the stock market. There’s a very good reason portfolio values have crashed; Congress just dumped a whole lot of gas on what was a controllable fire.

After eight years of slow but steady economic recovery we’re about to see a return to inflation – and all the bad stuff that comes with it.

Congress just voted to pass a budget that will add over $2 trillion to the deficit, weeks after ramming thru a devil’s brew of huge tax cuts for the wealthy, real estate investors, and big corporations.

The economic stimulus that will come from the budget and tax breaks is coming exactly when it isn’t needed – when the economy is well and truly recovered from the 2008 recession. Instead, this huge flood of cash arrives just as labor markets are tightening, wages are increasing, debt is getting more expensive and loans tougher to find.

In other words, inflation.

- Government borrowing is about to increase a lot.

- The cost of debt for companies, cities, states, school districts is about to go up – a lot.

- Millions of baby boomers are retiring every year, hoping to live off their 401ks. Which are worth a lot less today than they were – and will likely lose more value in the coming weeks and months.

- Demographics will drive health care costs ever higher – soaking up more of your personal funds and tax dollars.

From The Economist:

Public borrowing is set to double to $1 trillion, or 5% of GDP, in the next fiscal year. What is more, the team that is steering this experiment, both in the White House and the Federal Reserve, is the most inexperienced in recent memory.

American fiscal policy is being run by people who have bought into the mantra that deficits don’t matter. [emphasis added]

From Andy Roth, vice president of the conservative Club for Growth.

“With this deal, we will experience trillion-dollar deficits permanently…That sort of behavior, the last time I checked, is not in the Republican platform.”

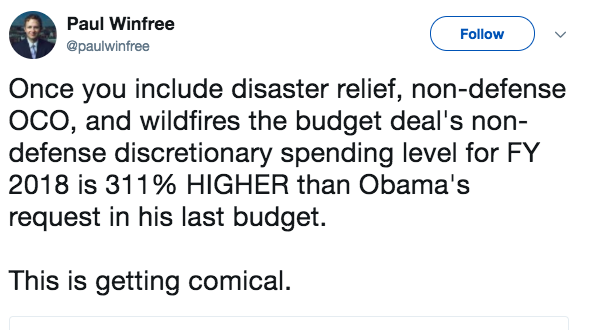

From Paul Winfree of Heritage Foundation and former Trump economic adviser:

There will be ups and downs in the stock market, but the irresponsible combination of unnecessary tax cuts and huge increases in spending means inflation is inevitable.

And the current crop of morons in DC doesn’t give a rat’s ass.

What does this mean for you?

Electing responsible adults would be a good start.