With sore feet, a pocket full of business cards, and an envelope stuffed with receipts, the work comp world is headed home.

My main takeaway from the NWCDC conference – Yin and Yang, black and white.

Serving patients and employees.

Congratulations to Starbucks and Noreen Olson, Claims and Risk Management for winning a Teddy Award. I met Noreen for the first time yesterday, and her passion for doing the right thing by her “partners” (that’s what Starbucks calls employees) came across loud and clear.

This from Risk and Insurance’ Autumn Heisler article on the award, quoting Steve Legg, director of risk management, Starbucks:

“We were focused on building up a program with an eye on our partner experience. Cost was at the bottom of the list. Doing a better job by our partners was at the top.” [emphasis added]

As a big Starbucks coffee fan, I like it even more now.

There was an entire track devoted to the advocacy model – which is terrific. But, we’ve got so far to go.

Let me explain…

The hall had too many vendors focused on how to reject claims, surveil patients, use tech to deny work comp benefits. I spoke with one that touted their tech’s ability to help payers use AI to show a worker couldn’t possibly have gotten hurt at work.

Yes there are cheaters, but they represent a small fraction of patients.

Several sessions involved InsurTech/data analytics/Artificial Intelligence. Kudos to the session selection folks (I am peripherally involved, but don’t have any role in those decisions) for helping educate all of us non-techies on this.

Sedgwick’s George Furlong and Stephany Rockwell of JBS talked about using tech to improve decision making; their session provided real world examples while pointing out the dangers of relying solely on machines to assess data and come up with recommendations.

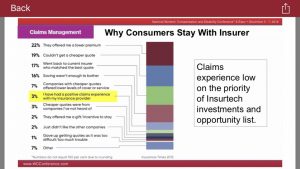

But much of this great tech isn’t focused where it should be – the customer interface. Reality is, dealing with insurance and insurers is a pain in the butt. Claimants are treated with suspicion, made to jump thru hoops, and generally not served well.

This from Gallagher Bassett SVP Jeff White’s presentation…

Contrast this with how Vegas treats visitors – everyone from cab drivers to housekeeping staff is welcoming, happy, courteous and out to make your stay a good one. The entire town knows its success – and each person’s livelihood – depends on you having a great time and telling everyone you know you did.

The contrast between the Vegas experience and how we treat “claimants” is a lesson in itself.

Opioids – progress – one patient at a time

I’m both very happy and deeply sad that opioids were the subject of several sessions. The solid attendance at these sessions speaks to the continued concern about opioids, and the focus on long-term chronic pain patients is critically important. The message – we CANNOT lose focus on this. We will be fighting this battle for years to come.

The good news is the growing recognition that we have to solve this one patient at a time. There are no general solutions, no silver bullets, but only a hard slog involving analyzing data, talking with each and every patient, designing a recovery plan specific to that patient, persisting when patients relapse.

One of the more realistic approaches is that developed by Carisk. I spoke at length with one of their customers, and came away heartened by the depth of understanding and focus on the patient.

Yes we are making real, meaningful progress; the work comp world has done so much more to reduce opioid use than every other payer system. We have much to be proud of – but there are still hundreds of thousands of patients taking way too many pills.

What does this mean for you?

Treat patients like Vegas treated you. And understand we are all individuals.

Joe – always a fan and love what you do. One quibble with the slide, unless I am misreading it – a very low % of most any insurer portfolio are claimants, by definition. So, unless this was taken from a sample claimant population only, we would expect that % to be low and a 3% value does not address the question as to whether claimants are happy with insurers’ service.

Hello Steve – thanks for the note and appreciate your perspective.

A much more comprehensive view of “service” is here from Bain. https://www.bain.com/insights/customer-behavior-loyalty-in-insurance-global-2016/ . My takeaway – and your’s may well differ = is there are “acquisition” sellers and “retention” sellers in the consumer market. The former sells on low price, the latter on service (an oversimplification but nonetheless valid statement).

In work comp, buyers go for price, which forces sellers to keep service costs low.

Put another way, many buyers don’t think about claims service, and to your point, as most small employers rarely have claims, there’s often little reason they would.

I’d suggest payers who are looking for client retention would do well to explain why that is important to prospects that might value that. We do know that dissatisfied claimants are far more costly than others. Correlation is not causation but this bears careful thought.

“The good news is the growing recognition that we have to solve this one patient at a time. There are no general solutions, no silver bullets, but only a hard slog involving analyzing data, talking with each and every patient, designing a recovery plan specific to that patient, persisting when patients relapse.”

Joe: Sage commentary above. Those trying to influence opioid policy with policy makers like CMS would be wise to ensure their proposed solutions comply with it.

Thanks Jeff – appreciate the kind words.

To paraphrase someone, if it was easy it would already be solved.