The short answer is – they have little incentive to do so.

Here’s why.

- Workers’ comp insurance is mandatory in all states save Texas. Pretty much all employers have to carry workers’ comp coverage, so sellers of insurance and self-insurance services (albeit to a lesser extent) know their prospects have a budget, timeline and decision process, and selection criteria. It’s not IF they buy, it’s whose they buy. That removes a big problem in sales – finding prospective customers.

- For most of the last decade, insurance rates have been dropping. Workers’ comp costs are at or near historical lows in almost every state. As a result, with rare exceptions, buyers aren’t focusing on workers’ comp – it is way down the list of things CFOs and Treasurers are worried about. So, they aren’t pushing insurers or TPAs to improve, get creative, develop new products and solutions and improve existing processes.

No problem – no need for a new solution. - That’s driven primarily by two key factors – frequency and medical cost.

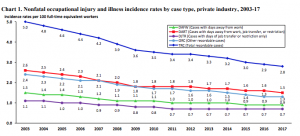

Frequency – the percentage of workers suffering an occupational injury or illness – has been dropping pretty steadily for decades. With fewer people hurt or sick every year, there’s fewer problems to solve. And yes, claim counts trended up till last year, but that upward trend was driven by increased employment.

- Despite what some vendors claim, medical cost trends are very much under control. Sure facility costs are increasing, but the decline in drug costs and related medical expenses seems to have offset that…so far. So, little incentive to come up with creative/fresh/different medical approaches.

- Risk:reward. With some notable exceptions workers’ comp execs are pretty satisfied with the status quo. Put another way, they are highly risk-averse. Most have ascended to their executive positions by not taking risks, by avoiding mistakes. Any new, creative, different approach is inherently risky and therefore anathema to folks who have succeeded in part by tightly managing risk.

By no means is this true of all execs; I’m privileged to be able to work with several payers that are pushing the boundaries, working very hard to come up with new and much better ways to help the injured workers and employers they work for.

What does this mean for you?

Workers’ comp buyers are mostly not interested in innovation or change.

One factor is that the distribution channel — brokers –are not strongly motivated to promote superior solutions to work injury risk. I don’t have enough exposure to them to accurately characterize their thinking, but from what I saw over the course of three decades were messagings that in effect suppressed or even censored discussion of superior approaches.

Thanks Peter – completely agree – with a few exception, Frank Pennachio being a great example, I haven’t seen much interest in really challenging employers or service entities beyond beating them up on price.

Well said and all true, Joe. Thanks for your candor. I don’t know any workers’ comp industry leader who truly believes the current environment is sustainable for another 100 years. Or even 20. We are at a crossroads where technology can (if unchained) go beyond reducing internal administrative costs to truly driving better medical outcomes, which can fuel both better benefits for injured workers AND even lower costs for employers. But to do that, and also address the imperative of attracting young talent to an archaic industry, leaders focused on workers’ comp innovation will need to further collaborate on, “What are the goals of workers’ comp today and how do we get there?”

Well said Bill.

I’ve recently heard that WC regulations have opened up the ability to pay incentives for outcomes. I’d like to hear your thought on rewarding providers based upon the quality of care. While this would raise the cost of the individual transaction, it could also lower the overall cost of care.

It takes competition to foster innovation and change. I have been in the industry for almost 30 years, I am getting old. During my career, I have witnessed first hand, claim administrators and carriers bundling other services, such as bill review, utilization review and investigation. This dropped the per claim fee down as these companies make most of their margin from the other bundled ancillary services. Young talented individuals may look at this model and ask the question, can I disrupt it? Can I bring innovation to claims handling and actually compete while eventually making a profit. We need true competition in the market to drive innovation and change.

thanks for the note Eddy. In order for disruption to be viable, the buyer has to want something different. I don’t see much – if any – evidence of that.

Any wonder why insurance is a bit of a backwater?

be well -Joe

I would disagree that all brokers aren’t motivated to lower their clients total cost of risk and focus on their variable expense related to losses. The good brokers understand the services provided by carriers and TPA’s and if positioned correctly in front of their clients can add real value to the relationship. A lot of brokers including myself came from the carrier side. Not the large majority, but if they pay attention to this blog then they are likely doing the right things.

thanks Brandon – in defense of Peter, I’d note that he did opine with the qualification that he didn’t have much exposure to the brokerage community. As with any industry, there are the motivated, driven difference-makers and then there are the rest.

Sounds like you are one of the motivated ones – keep fighting the good fight.

be well – Joe

Agree with Peter about the distribution system. As I’ve been saying for a long time: The workers’ compensation industry is state of the art 1990. The good news is that this presents many potentially lucrative entrepreneurial opportunities. The bad news is operationalizing those opportunities is often beyond frustrating. It requires persistence on a grand scale. Too often smart people with good ideas get tired and just give up. That’s sad.

True and it is also true as someone note that we are at a crossroads. Having had multiple discussions across the board with everyone from carriers and brokers,, to TPA’s and employers the reality is the motivation or lack thereof, is very different for each. Without diving deep into every category, what I have found is that many employers especially in this environment have become more involved (almost intimately) with their casualty programs. They want to know more so they can be empowered to make educated decisions regarding everything from the carriers they are insuring with to the vendors they are using to service their claims. In my 25 years I do not remember a time when more employers were sitting up and taking notice. Don’t get me wrong, I have spoken to a fair share that are still of the same, it works so leave it alone mentality. Even some who recognize the room for improvement but felt the benefits didn’t outweigh the effort to do so. Some this desire to change was organic due to a new generation of more technology friendly of leaders coming into play while others forced as result of the pandemic. When premiums across the board are increasing, every avenue has to be explored to increase efficiencies, and reduce costs. The good news is no matter how we have arrived there, change at this point, in my opinion is inevitable. My prediction is over the next 5 years we’ll see a significant shift in this industry.

Hello Damien – and thanks for your thoughtful note.

I don’t see the crossroads, or even any real motivation to do anything fundamentally different. There’s no question COVID is driving activity specific to the pandemic; I interviewed several risk managers who exemplified creativity, caring, and responsibility. Beyond that, I don’t see it. As for insurance premiums, I don’t know of any state that’s seen an appreciable increase in insurance rates over the last several years.

Workers’ comp is just not a high-priority issue among the employers I encounter; perhaps we are traveling in different circles. In any event, I hope you are right, as we have a long way to go.

Hey Joe, South Dakota is another state that doesn’t have a statutory requirement for employers to carry work comp. It’s just SD and TX.

thanks Dan – I did not know that – never knew SD didn’t require workers’ comp.

be well – Joe