Cheap stuff isn’t cheap…you always pay way more than you think…because the hidden costs of that cheap stuff are damn expensive.

Two examples…

Walmart’s slogan is “Save people money so they can live better.”

McDonald’s mission statement includes “make delicious feel-good moments easy for everyone.”

The two giants (and McDonalds franchisees) employ over 4 million workers, paying wages that are significantly higher than the Federal minimum (which is $7.65 an hour) – but certainly not a “living wage.” McDonald’s shift workers make less than $10 an hour; Walmart’s was a lot higher, almost $15 an hour.

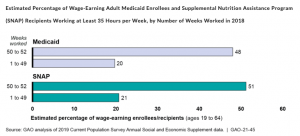

In just 6 states, 15,000 Walmart and McDonalds workers and many of their families are on Medicaid. Undoubtedly tens of thousands more get their healthcare from free clinics or in hospital ERs. This is especially true in states that did not expand Medicaid – looking at you, Florida, Mississippi, Arkansas, Alabama, and a dozen more.

The median cost of Medicaid – which is NOT per employee, but the employee and dependents enrolled in Medicaid – is about $8000. If we figure just 20% of Walmart and McDonalds’ employees on Medicaid have dependents, taxpayers in those six states are paying $120 million a year for Walmart and McDonalds’ employee healthcare.

Add to that the cost of uncompensated care for the uninsured – which is subsidized by overcharging privately-insured workers and workers’ comp payers – and its blindingly obvious cheap stuff is far from cheap.

This isn’t just Walmart and McDonalds; workers at Uber, DollarGeneral, Fedex and Amazon and many other companies get their health insurance – and supplemental food aid – from you, the taxpayer. In fact, more than half of Medicaid enrollees are employed by private companies.

Make no mistake – I’m not blaming McDonalds or Walmart or any other company for doing what they are doing – or rather not doing. Americans are addicted to buying lots of stuff (a lot of which is redundant or really not needed) and demand low prices.

What does this mean for you?

These companies are giving us what we demand, and we are paying a hefty price for cheap stuff.

Good points. But what is the solution? Socialized Medicine, higher taxes but a better quality of life? As you say, We are getting what we want….but are we?

Hi Anne – apologies for late response and thanks for a great question.

I’m careful to avoid labels for solutions, as folks seem to have their own views of words like “socialized” that detract from a productive conversation.

It’s important that we consider the trade-offs; yes we can have lots of cheap stuff, but it isn’t really “cheap” when you consider the total cost. Unfortunately there aren’t any campaigns or efforts to help us understand that what that “low price” actually is.

If I had the Emperor’s Scepter, I’d:

get rid of employer-based insurance and

increase corporate taxes to offset that windfall,

put in place an all-payer fee schedule (which is currently in place in Maryland),

require all payers to publish outcomes, and

require everyone to buy health insurance (with their contribution scaled based on income).

Thanks for another thoughtful post. I think you may be correct that taxpayers in all states are paying higher taxes to subsidize the employees of giant firms who need Medicaid. However, I want to make the following suggestion: maybe this is a good deal for taxpayers! Maybe the taxpayers derive more than $120 million, collectively, from the low prices at Amazon and Walmart among others. If my personal taxes are $200 higher due to Medicaid expansion, and I shop a lot at Amazon et al, maybe I am ahead.

One more point: it may not be possible to give every American a high enough wage to afford health insurance (surely not to afford a$20,000 family premium). Maybe we are better off paying Medicaid taxes.

Hey Bob – good to hear from you.

What about the taxpayers that don’t buy at WalMart, Amazon, DollarGeneral. McDonalds et al? It’s also an inefficient way to pay for healthcare.

It is possible to give every American a high enough wage to afford healthcare – if we force prices down and remove incentives for massive overtreatment. Unless and until we do, we’re screwed.

be well Joe