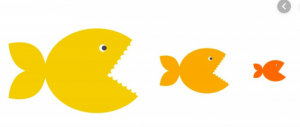

What’s coming is quite clear – there will be more consolidation in the work comp services industry, much of it likely in the next 12 months.

Workers’ comp is a shrinking industry; while there may well be occasional increases in premiums, claims counts, and spend, in general the long term trend is crystal clear – the only way to sure way to grow is to acquire other companies.

TPAs are growing in size and influence as many carriers pull back on investments and spending on technology, training, and physical assets. Many – but by no means all – carriers see significant potential benefits in moving claims services to TPAs:

- the cost of claims becomes entirely variable, replacing much of carriers’ fixed costs;

- flexibility – it is much easier to enter and exit states if you don’t have to stand up/shut down claims operations;

- regulatory compliance – specifically staying up on and complying with claim-related requirements becomes the TPA’s responsibility (sure the carrier is ultimately responsible, but it can protect itself contractually)

In turn, TPA growth is affecting medical management, technology, and other services vendors…TPAs make big dollars from revenue sharing with those vendors, with obvious implications for claim closure, claim duration, and medical, indemnity ALAE expenses.

The big players in the service sector are Mitchell/Genex/Coventry (MGC), Paradigm, Conduent, Optum Workers’ Comp, OneCall, ExamWorks and one step down, MedRisk (HSA consulting client).

I’d add Sedgwick to the list albeit with an asterisk; as the largest payer in workers’ comp (outside of the Federal government) it has the market share and negotiating leverage to do what other payers can’t…BUT this power will diminish as the number of service providers shrinks and their leverage grows.

These players are snapping up smaller service providers, broadening the depth and breadth of their offerings while simultaneously strengthening their relations with payers. Buying companies with >$75 million in revenue is helpful strategically and financially, but the bigger these companies get, the less benefit they get from adding “tuck-in” acquisitions.

This week I’ll share what I see coming, how each of these entities stacks up, and what this means for carriers such as Travelers and the Hartford that are staying the course.

What does this mean for you?

Change is coming; success, and survival, favors the prepared.

I agree that we will see an up tic in M & A activity. What will separate the winners from the losers wil be the ability to effectively integrate these acquisitions. Historically, we have not seen great success from many of the past mergers in truly capturing the synergies promised.

Hello Skip = good to hear from you and hope you are well.

Your point re integration is an excellent one; there’s not been nearly enough attention paid to the hard work of figuring out exactly how the new company will be “better” than it’s component parts.

Alas most of the focus on “better” seems to be convincing the next buyer the enterprise is going to generate a big return. “value” to the industry, patient, employer…not so much.

be well – Joe