Over the last two decades work comp bill review has A) changed a lot and B) remained stagnant.

Both things are true…

Here’s the top takeaways from our just-released Survey of Workers’ Comp Bill Review (public version is available here; respondents received a much more detailed version).

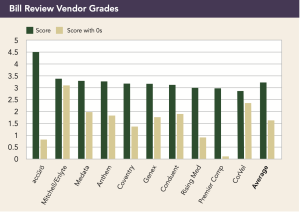

Top findings are as follows (scores are 1 – 5, with 5 being highest):

- The BR industry’s overall rating from 2018 hasn’t changed, with an overall average grade of 3.2.

- Today there’s almost no differentiation in ratings across the major vendors; scoring has become more compressed since 2018.

- Customer service is of utmost importance in establishing a successful BR relationship. It is the primary reason respondents gave for changing vendors.

- There is a noticeable difference between executives and front-line employees in the evaluation of their BR vendor’s customer service. Front-line employees’ average score was 3.6, while executives scored 4.2.

- Automation is a hot topic in the industry, with a focus on improving turnaround time, auto-adjudication, and quality. However, some respondents are still looking for their BR vendor to better handle basic tasks.

- E-billing is gaining popularity, particularly among larger respondents and those who handle BR internally.

Couple deeper dives.

As noted above the survey included both front-line staff and management respondents; it won’t surprise many readers to learn front-line folks are not as satisfied with their BR vendor as their titular superiors are...that’s because execs value “savings” (which are mostly ephemeral as they are just reductions below some arbitrary benchmark, not actual medical cost reductions) – while front-line workers value efficiency, simplicity, clarity and quick problem resolution.

Since execs make buying decisions, vendors mostly focus on what I would argue are often meaningless metrics. (don’t get me started on reductions below billed charges…)

More broadly, since our first BR Survey way back in 2009:

- there’s been major consolidation…there were more than 11 vendors back then (remember Stratacare? CS Stars? CompReview? Ingenix?) and market share was pretty spread out. Today, the number of vendors hasn’t shrunk much, but market share is much more concentrated.

- BR vendors have yet to embrace real payment integrity tools. There’s way too much “we know what we are doing” and way too little “we can always get. better”. The arrogance of ignorance is nowhere more entrenched than among BR company execs (not all, but almost all).

And that, dear reader, is because buyers aren’t pushing vendors hard enough.

That is NOT to say some payment integrity vendors aren’t at fault; they are too rigid in their pricing or workflow requirements, just too hard to work with.

What does this mean for you?

Buyers – push harder.

BR companies – you can do better. A LOT better.