Delta (my favorite airline) isn’t forcing employees to get vaccinated. It is charging the unvaxxed more for health insurance.

Ochsner Health system in Louisiana is following suit, adding the same surcharge for spouses or partners that are not vaxxed in an effort to help cover the $9 million in costs the system spent on caring for workers infected with COVID – and pay for future expenses. The unvaxxed will have to pay $200 more per month and comply with strict testing requirements.

Financial giant JPMorgan will charge unvaxxed employees more for health insurance as of January 1 2022.

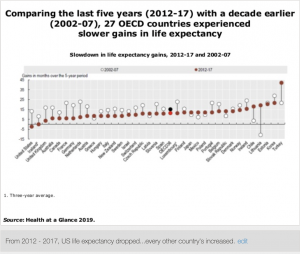

Those who come down with COVID are also going to see higher out-of-pocket costs as more insurers pull back on the first-dollar coverage they were providing for COVID care. Average out-of-pocket costs around $3,800 are expected for unvaxxed patients hospitalized for COVID treatment.

While a lawsuit has been filed by some Ochsner employees seeking to overturn the surcharge, legal experts dismiss any chance of success. CMS has told self-insured employers they cannot refuse to provide coverage for unvaxxed patients’ COVID care, but they can charge those members more. This is consistent with regulations regarding tobacco use, which can result in insurance surcharges.

Meanwhile, many of Delta’s competitors are mandating vaccines, perhaps in part because unvaxxed workers mostly comply with mandates. And all the data to date indicates the vast majority of workers are getting the shot rather than the heave-ho.

One expert noted the surcharges are a powerful emotional tool, stating:

“There is this idea of loss aversion, that losses are weighed more heavily than gains, so a $200 incentive will not have as much influence as a $200 fine.”

What does this mean for you?

Unfortunately, sticks seem to be more effective than carrots, at least for the most committed of the vaccine holdouts.