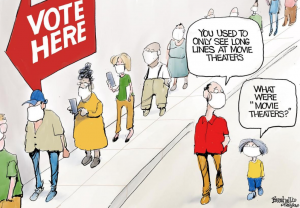

So, who knew masks could be so dangerous?

In our continued effort to keep us all honest about “science” and “research”, I have to weigh in on a recent piece wherein some folks seem to be concerned about mask wearing’s impact on a person’s health. The Risk & Insurance piece noted:

A study (italics added) conducted by PN Medical, and as reported in The New York Times, found that extended mask wearing could lead to improper breathing, which could result in possible negative side effects such as anxiety, headaches, increased heart rate, dizziness and fatigue.

This wasn’t a “study”; it was a “small investigative trial”. Details are here.

The person who described it is not a clinician.

There’s no information on how many subjects were involved, if there were any controls, the demographics of the test subjects, the methodology used, how the multi-site “trial” was conducted to ensure consistency, weather conditions, temperature and humidity, time of day, and the many other factors that could influence a person’s post-mask behavior and physiology.

The story goes on to describe all the bad stuff that “might” happen, all of which are assumptions based on assumptions based on what is most definitely not credible research.

Further, the story is based on another reporter’s failure to accurately describe the “small investigative trial;” a New York Times reporter at that.

It is entirely possible that masks cause some issues…but they’ve been in use for decades and this is the first report I’ve seen that there is any concern.

We need to do better, folks.

IWP gets hammered by Massachusetts’ Attorney General

Finally, IWP Pharmacy, long the bane of many adjusters, agreed to a Consent Decree that requires major changes at the Massachusetts-based mail order pharmacy. Mass AG Maura Healey announced that IWP will pay an $11 million settlement and make major changes to resolve:

allegations that it failed to implement adequate safeguards against unlawful and dangerous dispensing, resulting in the shipment of thousands of potentially illegitimate controlled substance prescriptions across the country.

In perhaps the most stunning example of spin I’ve yet seen, IWP’s statement doesn’t even mention the settlement… in a post entitled “IWP Expands Compliance Program” the multiple changes to staffing, operations, compliance, and sales were characterized as:

steps…developed in collaboration with the Attorney General of Massachusetts, as part of a recent review they undertook of past business practices.

The AG’s statement read in part:

“Injured Workers Pharmacy created an illegal operation that put dispensing speed and volume over patient and public safety…They dispensed thousands of prescriptions for dangerous drugs, including opioids like fentanyl, with a shocking lack of regard for whether those prescriptions were legitimate.”

What does this mean for you?

Question reporting and go to the primary source.

Check your files for IWP patients.