There’s lots of news out there about the Congressional Budget Office’s scoring of the Republican healthcare reform bill known as AHCA; we’ll narrowly focus on what passage of AHCA would mean for workers’ comp – and highlight what’s missing from every other analysis of the CBO report.

Briefly, I’d expect case-shifting and claims-shifting to workers comp to increase significantly, resulting in higher work comp expenses for employers, and more business for the work comp service industry.

Here’s why.

The expansion of Medicaid and the individual mandate covered about 13 million more workers than pre-ACA; 81% of Medicaid recipients’ families have at least one member working. When workers who have health insurance get hurt, they are less motivated to claim it was on the job. And, if they are hurt on the job, work comp doesn’t have to pay for non-occupational medical conditions (e.g. dealing with hypertension before doing surgery).

The newly insureds are also working in jobs with higher claim frequency than average.

Some argue that the high deductibles and copays common in some insurance plans negates my argument; I respectfully disagree. That’s because the newly insureds are poorer than average, thus they are much more likely to either:

- get premium support payments from ACA which also cover deductibles and copays or

- be covered by Medicaid, which has no cost-sharing (except in Indiana).

Since ACA was fully implemented in 2014 we’ve seen historically-low work comp medical trend rates, a strong indication that ACA is a major factor in lower work comp costs.

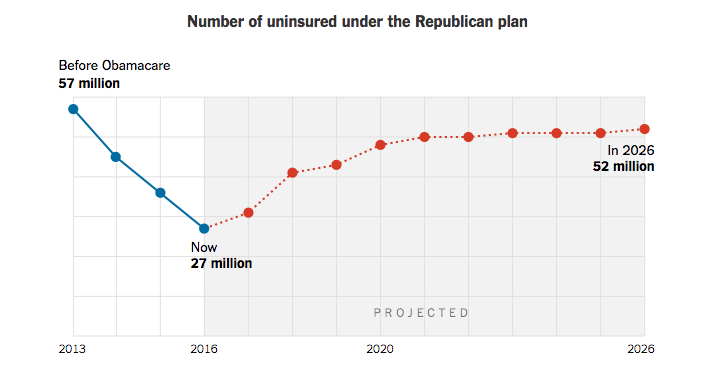

- 14 million will lose health insurance next year

- 7 million more by 2020

- another 5 million will lose coverage by 2026

- most of those losing coverage would be older

- deductibles and copays would be higher than under ACA

(credit Washington Post)

All of these projections are bad for work comp; older workers’ injuries are more expensive, and the higher deductibles and copays, along with a big drop in Medicaid coverage, would financially motivate workers to “claim shift.”

(credit Washington Post)

So, those losing health insurance would be:

- much older

- more likely to be employed in higher-risk jobs

- more likely to be currently covered by Medicaid

What’s missing

…from all of the press reports and analyses of the CBO report is a discussion of how providers would react to passage of AHCA. That’s in part because the CBO report (full copy here) doesn’t address the issue.

Insurance coverage is just part of the story; doctors, hospitals, pharma and other providers are going to be hugely affected by a big decrease in their customer base.

More on that tomorrow.

What does this mean for you?

For work comp payers, higher claims and higher medical bills.

Does it seem like we are going in circles? It makes sense when people don’t have healthcare insurance and they get hurt, they will try to find a way to get coverage. If they work, then WC seems like a good fit. What is the solution….single payer system where everyone is covered. END OF STORY. We the people of the US have to accept the inevitable.

Can you explain the difference between no cost sharing and when my poor patients on medi-cal have to cost share?

http://www.chcf.org/publications/2010/09/share-of-cost-medical

I believe that’s explained in the link; more detail provided here – https://www.sfdph.org/dph/files/CBHSdocs/BHISdocs/UserDoc/MediCalSOCFactSheet.pdf

Thanks, Joe. Can you point me to supporting opinions that many of the additional uninsured will ‘be older people? I don’t see that (am I looking right at it?) as this summary says: “CBO and JCT estimate that, in 2018, 14 million more people would be uninsured under the legislation than under current law. Most of that increase would stem from repealing the penalties associated with the individual mandate. Some of those people woould choose not to have insurance because they chose to be covered by insurance under current law only to avoid paying the penalties, and some people would forgo insurance in response to higher premiums.”

Emphases on ‘MOST… from repealing the penalties…’ seems to mean that Americans are back to a choice to purchase (or not) and since past studies show younger people feel they are ‘bullet proof’ and won’t buy if they have a choice – yet older, higher risk people value healthcare and will pay more premium as they are higher risk and need/use it? Isn’t this just underwriting 101? I sure know that in ALL other areas of business, higher risk = higher premiums/cost and lower risk = lower premiums/costs? Help me understand why we should throw this common sense proven underwriting out the window and charge the same cost for a 25 year old and a 60 year old? That’s like charging the same auto premium for a driver with several DUI’s on their record as someone with a perfect driving record?

Hi John – if you keep reading, the summary indicates that premiums will be substantially higher for older people.

To wit:

Under the legislation, insurers would be allowed to generally charge five times more for older enrollees than younger ones rather than three times more as under current law, substantially reducing premiums for young adults and substantially raising premiums for older people…

There is much more detail in the report itself, and from numerous other sources e.g. here, which has this reference to the report.

“a bigger story is that millions—CBO does not say how many—of low-income, older people would lose coverage under AHCA because they could no longer afford it after the age rating ratio and premium tax credits changed.”

No one is suggesting there should be one premium rate regardless of age. Currently ACA has 3, the AHCA is proposing 5 age bands.

Ok, thanks. There is so much information (and partisan misinformation) out there, I am trying to read from both sides to stay educated and wade thru all this. These summaries say one thing, then the very next paragraph or next opinion quite the opposite. For example in your link it states under the section: Premiums: Increases, Then Stabilization:

CBO projects that those who dropped coverage between 2017 and 2019 would be disproportionately healthy, resulting in premium increases in 2018 and 2019….

I don’t interpret the older population as being ‘disproportionately healthy’ as that makes no sense. To me, this is referring to younger people. I don’t wnt. To pull one thing out of context and generalize for all, so will dig into the additional information you shared in my ‘spare’ time (whatever that means).

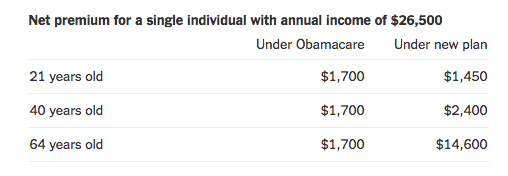

Regarding same charges for various ages, I was referring to your Washington Post chart showing both 21 year olds and 64 year olds paying the same net premium of $1,700 under ACA.

https://www.joepaduda.com/wp-content/uploads/2017/03/Screen-Shot-2017-03-14-at-7.33.46-AM.png

John – the population that will likely drop coverage is the younger healthier population. As a result premiums will jump for everyone else as that group helps cover expenses for us older folk.

re the WaPo chart it refers to “net” premium for a low-income adult. that’s what makes the premiums level. Under AHCA, the older enrollee’s net premium would jump to around $14,600. That’s what drives them out of the market.

John – and you can ALWAYS rely on MCM for the real scoop! we are a “Fake News Free Zone”

Ha ha ha ha… absolutely — like I said, I’m reading BOTH sides of the story…. and I am keeping my post election commitment to not reside in the ‘echo chamber’ but instead hear both sides…. (:

It looks like you dodged the treacherous Snowmageddon but enjoy the freezing sleet (it’s 70 degrees here today).

we’ve got 8 inches so far with another foot coming. But the Kubota is up to the job.

I also suspect there will be an uptick in SSDI applications, similar to what happens during recessions. Not sure if the SS judges will be finding more or less applicants are disabled, but this will also eat into Medicare’s viability into the future since SSDI recipients will be getting Medicare after their SSDI awards. Should become insolvent faster because people will be getting it sooner, and the ACA actually extended it’s viability by a few years.

Joe, thanks for the insight. Have you seen any studies that directly show the impact of the ACA and WC results? I’d be curious to see if the improvement in WC Loss ratios is significant enough to credit the ACA or if it is just UW improvement/cycle as well as exposure growth.