USI’s 2018 Insurance Market Outlook indicates workers’ comp medical inflation will hit 6 percent, a significant jump over recent years. A key driver is:

“a continued increase in cost shifting from healthcare plans to workers’ compensation due to the profitability challenges faced by the Affordable Care Act as well as other challenges”

I’m puzzled by the scant attention paid to medical cost in the report, and the superficial, and I’d suggest misleading attribution of cost shifting to ACA’s “profitability challenges”.

What “profitability challenges?”

Health insurers are doing quite well. Pharma and device companies are too. Hospitals are rolling in dough, with profits up 43 percent from 2011 to 2016. Sure, around 20% – 30% of hospitals experienced negative margins – but the average net margin was a very healthy 7.7%.

Medical costs drive a LOT of casualty insurance costs in the auto, fleet, workers’ comp, medical malpractice, and liability lines. The quote above is the only substantive statement in the 38 page report, and the statement itself is questionable.

Granted, I’m biased. As one who grew up in and remains firmly rooted in the healthcare world, I see things thru that lens. That said, my take is the lack of focus on medical is due to a lack of understanding of healthcare, which in turn makes conclusions suspect.

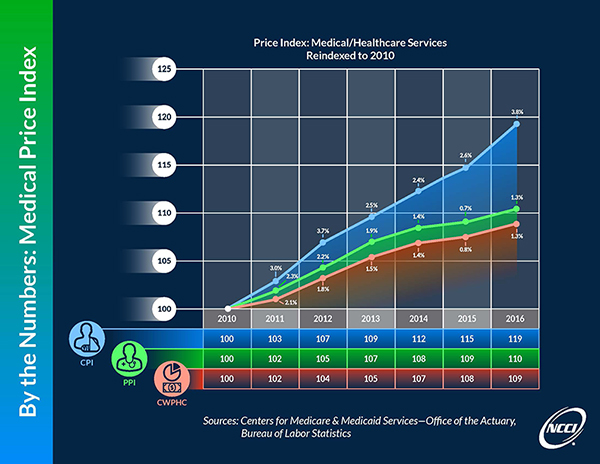

NCCI recently changed its measure of overall medical inflation to a metric that more closely tracks what we’re seeing in work comp. The discussion at the link is pretty wonky; suffice it to say that the Personal Healthcare Deflator (PHC) tracks actual workers’ comp medical trends much more closely than the Medical CPI. (James Moore wrote on this some time ago)

(source NCCI) You’ll note that the PHC Deflator predicts a much lower rate of price inflation than the other more commonly used metrics; PHC does factor in a change in the mix of services, which I’m guessing is a key reason. (In group/Medicare/Medicaid there’s been a significant shift in the location of services from hospital to non-hospital providers which has reduced overall costs.)

It’s impossible to say how USI came up with their estimate of 6% medical cost inflation; it is possible they used the CPI or some other metric. I’ve got a query into USI and will update this if/when I hear back.

In the interim, I’d suggest we would be well-served if the industry showed a bit deeper understanding of the key driver of claims costs.

After 30+ years in this industry, I’m still amazed at the superficial understanding of healthcare exhibited by most in work comp. The continued emphasis on network penetration and per-line and per-bill “savings”, the failure by most buyers to force insurers and TPAs to report real outcomes, and the resulting lack of real improvement in health care quality in work comp is appalling.

What does this mean for you?

We’ll dig into the drivers of medical costs more this week. It’s a bit complicated, as most important things are.

3 huge cost containment factors in WC have really done well in controlling medical inflation in WC – WCRI and NCCI both do great research in this area

1) Impact of fee schedules

2) Treatment guidelines

3) Mix of services (providers and payers both love outpatient from cost and margin perspectives)

Joe,

Outside of provider motivation, could cost shifting from benefit plans to worker’s compensation come more from employee motivation? Benefit plan sponsors continue to shift costs to members in the form of co-pays and higher deductibles, so workers’ compensation becomes an attractive option to some employees because it is “free.”

Could continued cost shifting from sponsors to members accelerate this trend, even with a growing percent of the population covered by a higher employment rate and the ACA?

Also, back to the provider motivation, do you think the combination of higher reimbursement rates paid under workers’ compensation (many state fee schedules are a multiple above Medicare rates) combined with lower AR (attributed to the fact that it is easier to collect from carriers, TPAs and large employers than chasing individual members for their portions of bills) incent provider cost shifting to workers’ compensation?

Hi Matt – thanks for the note – there are any number of factors that would encourage/discourage cost and case shifting. It’s very difficult to know if this happens, how it happens, who does it, and what the impact is.

Net is my sense is facilities are more likely to look to workers’ comp, and more able to pursue cost- and case-shifting tactics.