You or your spouse may well have a pre-existing health condition, one that, back in the bad-old pre-ACA days would have made it hard if not impossible to get insurance coverage in the individual and small group insurance markets.

Those days may be coming back.

A Texas court case is scaring the bejesus out of many; the Trump Administration and several state attorneys general are suing to overturn provisions of the ACA that require health insurers to cover pre-existing conditions.

If this scares you, you’re not alone. More than half of people polled are afraid their insurance costs will go way up, and 4 out of ten think they may lose insurance coverage if insurers no longer have to cover pre-existing conditions.

An old athletic injury, skin cancer, stomach trouble, anxiety, a heart murmur, migraines, allergies – all those and many more are pre-existing conditions that, if the lawsuit succeeds, would likely prevent you from getting individual insurance coverage for those conditions – if you could get insured at all.

Before the ACA,

- you couldn’t leave their job to try something new or retire early – a condition known as “job lock”

- small employers’ costs went up dramatically if workers got sick or had specific conditions because their insurer wanted to dump them.

Under the ACA, insurers must cover pre-existing conditions, and can’t charge individuals, families, or small businesses more based on those pre-ex conditions.

This strikes me as eminently fair; I had cataract surgery and started getting migraines years go, and until the ACA I had no coverage for ANYTHING related to my eyes or brain. That was pretty scary; any medical care related to those rather important organs was money out of our family budget.

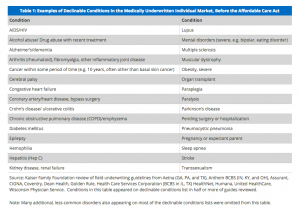

Here are some of the conditions that you are insured for under the ACA, conditions that would not be covered if the lawsuit succeeds.

I’m all for freedom and choice and all that stuff.

What I’m vehemently against is stupid public policy that results in you going bankrupt because an insurer won’t cover your pre-existing condition.

For those who claim the “free market” will fix this – you are smoking crack. No insurance company will cover your pre-ex condition – or your spouse’s, or kids’ – unless they are forced to.

What does this mean for you?

If Trump et al win this suit, your freedom to change jobs just disappeared.

This is a little troublesome to me Joe. The insurance companies already stack the deck in their favor. Of course, if they are not mandated to cover pre-existing conditions they won’t. It will be worth watching this case to see what happens.

Mark – agreed. I worked for group health insurers in years past, and medical underwriting in the small group market was a key part of insurers’ strategy.

To make the markets work, there has to be A) mandatory universal coverage and B) no medical underwriting of any kind.

Joe, this is alarming to say the least. If passed, it will only create chaos, stress and further deterioration of our overall health, while eroding confidence in the system. This impacts nearly 130 million adults in the US under the age of 65 who have a pre-existing condition.

Hi Jill – thanks for the note. Unfortunately you’re right.

This is way more complicated, and I can see both sides of this argument.

As you know, the way insurance works is that enough premium must be collected to spread risk across enough policy holders to have enough to pay out claims. In all other forms of insurance this is done by underwriting policy by risk (e.g. DUI, speeding tickets, expensive car = higher rates or no coverage, Flood Plain, expensive house = higher rates, etc.)

By forcing insurers to take everyone and charge them the same rates, it removes the ability to underwrite based on risk, and ultimately premiums across the board have to go up. The winners are those that couldn’t get coverage before, but the losers are those that had coverage before and are now paying more. Ultimately, we have seen this policy cripple the individual markets in most states as the increases in premiums priced out the “young healthies” leaving only the sick and high-utilizers. I think you have pointed out before that most large health insurers are leaving the individual markets due to the unprofitability. This side would argue forcing insurers to take everyone, hurts more people than it helps, and potentially puts insurers in an unprofitable situation.

The other side would argue, that unlike car/auto/life individuals have less control over most of their health conditions compared to their driving record or type/location of house. It is it ethically inappropriate to penalize individuals by making them pay more or not providing coverage for health conditions.

End of the day, I am not really sure there is a good answer as it is lose-lose, and I am not really sure who is fighting this. Most of the big insurers have left the individual markets due to unprofitability and I am not sure they are trying to get back in them. Maybe it is a fight over principle and over-regulation.

Joe: it’s worse than that. The AG’s and 2 governors are arguing that without the individual mandate and inclusive tax penalty if one were to forego insurance, the entire ACA is unconstitutional. So not only would the pre-existing provision be gutted, it would eliminate whatever is left of the ACA that the R’s have been unable to overturn by legislation or in the courts. All very troubling and will continue to be so until the pain of excessive GDP of healthcare and the impact on employers makes providing healthcare unaffordable (from a business sense) we will continue with this disjointed h/c system. While single payor has it’s issues –both political and financial– at least it has the potential to eliminate a significant administrative cost from the equation. If Medicare can operate on a 95-96% medical loss ratio (albeit a VERY large number) as opposed to the 80-85% mandated through the ACA or worse pre ACA….that seems to bode well for some form of single payor or government option. Sadly we’ll have to wait 2+ years to see if that’s even feasible in this tumultuous political environment