Barring some catastrophic exogenic event (war with Iran, pandemic, sudden recession) – workers’ comp premiums will continue to shrink.

Meanwhile, despite compelling evidence work comp execs are worried about the opposite problem – that they won’t be able to raise rates high and fast enough if something bad happens. This at a time when industry profits have never been higher, insurers are awash with cash and all indicators point to continued low combined ratios.

Claim frequency continues to decline (yes there are increases here and there but these are NOT altering the decades-long trend). I penned a four-parter on frequency a while back that provides more detail.

The large and mid-sized payers I speak with are seeing declines in claim counts.

Medical costs are flat – and have been for several years.

Yet NCCI’s poll of workers’ comp execs finds these folks are worried about rate adequacy. (that means claims costs will go up faster than insurance premiums, leading to financial losses for insurers)

Wrong problem, folks.

The real issue facing C-Suiters is declining premium dollars – which means less money to pay for administrative expenses – which means fewer dollars to invest in:

- IT and new IT projects

- revamping claims systems

- electronic connections to providers, vendors, and other third parties

- adjuster training and retention

- innovation

I get that CEOs have to do worse-case scenario planning – but the chances of that worst-case (claim costs increase and rate increases can’t keep up) happening are minimal. Yet this “problem” is top-of-mind (according to NCCI) – so execs are:

investing in predictive analytics to help with pricing and dedicating more resources to actuarial research and analysis. Insurers are closely evaluating and monitoring risks for the purposes of acceptability, pricing and coverage.

There is compelling evidence that rates are too high now – and will remain too high for some time to come. The cause is the steep drop in opioid usage among work comp patients, a drop that is slashing claim duration, increasing claim closures, and reducing reserves.

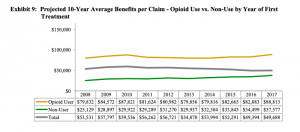

Opioid users’ claim costs are more than double non-opioid users. As usage plummets, rate decreases lag far behind. The result – today’s rates are based on what happened years ago – not what’s happening now.

Graph courtesy CWCI, p 19, The Impact of Declining Opioid Use on Lost-Time Claim Development & Outcomes in California Workers’ Compensation

While the impact of rapidly decreasing opioid usage – and concomitant reduction in claims costs – is real indeed, rating models and methodologies haven’t caught up to this reality.

This is the problem execs should be devoting most of their time to – how will they manage their business with less revenue than they have today.

The time to fix the roof is when the sun is shining. Work comp execs would be well-advised to invest their record profits in ways that:

- improve efficiency,

- automate low-value tasks, and

- most importantly – assure effective medical care.

What does this mean for you?

You don’t want to be on a roof in a rainstorm.

More on this in a free webinar hosted by WorkCompCentral February 27. Register here.

.

Workers compensation costs have not been declining. Medical has continually trended upwards almost everywhere over the last 20 years. Medical costs on catastrophic claims are up tremendously. Expense costs are also increasing. The downward trend in rates has been almost entirely driven by declining frequency. However, in the retention market frequency is not what drives rate, it is severity.

Carriers are worried about pricing because of the data lag. It takes 2-3 years for changes to show up in the actuarial models. Given the extremely long tail in workers’ comp it is very likely that rates in some states are too low right now to cover the long-term costs in an investment environment that sees very low yields for carriers.

You are very correct that in this rate environment it is a challenge for carriers to find money to invest in innovation. Public companies are judged on quarter to quarter earnings making it very difficult to justify a large increase in expenses that may produce savings several years down the road.

Hello Mark – thanks as always for the comment.

I’m a bit surprised that you indicate WC costs have not been declining. Every research study I’ve seen indicates the opposite is the case. If you have sources to back up that assertion please shoot them over or post them.

here’s one source

The National Academy of Social Insurance’s report is https://secure.nasi.org/civicrm?page=CiviCRM&q=civicrm%2Fmailing%2Fview&reset=1&id=3312. Free to download, NASI’s latest finds:

Employers’ costs have fallen from just over $1.50 per $100 of covered wages in 1997 to $1.25 in 2017.

Not sure if you had a chance to see the link to NASI; their study conclusively shows work comp medical costs are, indeed flat over the last few years.

If you have other sources I’d be interested in seeing them. I’d note that NCCI does not take into account several key states, including California.

Your point re lag is exactly what I am saying – however I contend that carriers are NOT paying attention to the key data point – the impact of the opioid reduction as demonstrated by the CWCI study referenced in my post.