The implications of Mitchell’s acquisition of Coventry’s workers’ comp business are broad, from insight into the future of M&A in workers’ comp services to impact on competitors. (press release is here) Today we’ll dive into a few of the top-line implications.

M&A

The $850 million price was likely driven largely by the network’s profits and sustained position as the work comp PPO industry leader… the PPO is by far the biggest revenue and margin generator for CWC (Coventry Workers’ Comp). The transaction also represents yet another step in the rapid consolidation in the work comp services industry.

Mitchell now owns the number 2 bill review application (by customer base), the largest medical management entity (Genex + Coventry), the largest case management business (a mixed blessing these days), and the dominant network. If it holds onto both PBMs, it will gain the number three position in that sector.

As I noted yesterday, Mitchell is likely off the major acquisition field for a good while. It has to fix its PBM business, integrate Coventry, develop and implement a customer outreach that ideally will result in more stuff being bought by more customers, ensure Coventry’s distributors (including bill review rivals Medata and Conduent) continue to offer Coventry’s network, all while dealing with COVID19’s impact on work comp and auto claims.

The other big players left in this business are OptumWC (network, PBM, ancillary services), Paradigm (cat case services and management, case management, some network and ancillary businesses), and One Call. The next tier includes bill review/document management company Conduent; physical medicine expert MedRisk and myMatrixx (number 2 PBM, both are HSA consulting clients).

I don’t see any of these entities scrambling to react to the deal; they’ve known about it for months, and outside of Optum and Conduent any impact is tangential.

Networks

Coventry’s PPO is the industry leader – and has been for decades. It has the most market share, is rated highest by customers, and its policy of demanding top billing in any state (primary network status) remains secure. Expect Genex to invest heavily in the PPO. This will secure its leadership position and hold off competition from newer entrants – primarily Optum.

Bill review

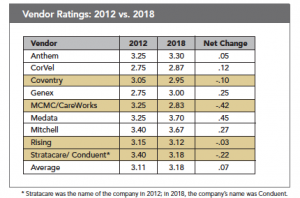

The market’s perception of Coventry’s bill review function indicates room for improvement. The chart below shows how BR buyers rated the top bill review entities’ customer service in a survey I conducted two years ago; service is THE key metric. [shoot me a comment if you want a copy of the survey, the comment won’t be published]

As I noted yesterday Conduent handles much of Coventry’s bill review; How Mitchell will address this is an interesting question.

If you’ve got additional questions, leave them in the comments section and I’ll do my best to get answers posted.

What does this mean for you?

Smart acquisition at a very good price makes Mitchell the leading entity in workers’ comp services. I wouldn’t worry too much about Mitchell gaining too much market power.