Pretty terrific.

Put another, more awkward way, COVID’s been very, very good to work comp insurance.

Yesterday kicked off the NCCI Annual Issues Symposium with CEO Bill Donnell’s introduction. Bill set the right tone – we’ve all been humbled, learned not to take anything for granted, and adapted.

The State of the Line address was again led by Chief Actuary Donna Glenn. Donna and her colleagues spoke extensively about the impact of COVID – fewer total claims and a big drop in premiums especially for main-street businesses, hospitality, retail and personal transport (my label, not her’s).

Financial highlights

Net written premiums were down 10% for state funds and private carriers.

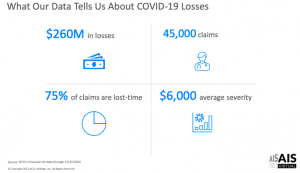

Early numbers indicate a calendar year combined ratio of 87% with $14 billion in excess reserves – and only $260 million in COVID losses.

But this financial heyday wasn’t just due to COVID. Last year was the 8th year in a row for rate decreases – many of them in the double-digit range; rates continue to drop, with the vast majority of states seeing significant Year over Year decreases.

Despite plummeting rates, the combined ratio (claims plus all admin costs) has been under 90 for four consecutive years…so rates are STILL too high. While Donna characterized the underwriting gain as a measure of “financial strength”, I’d suggest one could also call it “over-pricing”.

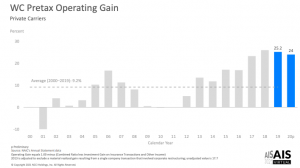

Unpacking the combined ratio we find loss ratios have been under 50% for three years in a row. Investments gained 11% last year. The result – a 2020 pretax operating gain of 24%.

That, esteemed reader, is a very hefty profit margin.

Even heftier when one adds in the $14 billion in excess reserves.

COVID

The average COVID claim cost $6000, and about 75% are lost time claims. COVID claims represented 7% of LT claims.

“Indemnity only” claims are those that had no medical costs – and are pretty much unique to COVID claims. Makes sense when you think about how most of us are affected – a couple weeks of misery at home, followed by a steady recovery, with no external medical care..

Even COVID claims with both indemnity and medical costs ran up $18k in costs – about half the cost of the average WC LT claim.

95% of claims were less than $10,000, 1% of claims accounted for 60% of losses – these tended to be inpatient claims, often with ICU utilization.

My takeaways.

First, work comp is VERY profitable.

Second, insurance rates are still much too high. (Even if claim counts rise, there’s a LOT of excess reserves sitting in insurers’ coffers.)

Third, all the caterwauling about how awful COVID’s impact on work comp was flat out wrong. More to the point, much of it was avoidable if those predicting awfulness had thought about how COVID is treated.

Mark Priven and I – and I’m sure others – figured this out last summer; this isn’t to blow our horn but rather to show all the indicators were there – if one just knew to look for them.

I believe this is because most people in workers’ comp don’t know or understand health care, medical care, health insurance, provider business practices – pretty much anything about the biggest driver of workers’ comp costs.

And that’s why they got COVID predictions so wrong.

Important footnotes.

NCCI data is NOT workers compensation industry data. In fact, it represents less than 1/3 of the industry data. It is a mistake to make sweeping statements about an entire industry based on 1/3 of the data.

Also, the occupations most impacted by COVID, healthcare and first responders, are mostly self-insured and thus missing from NCCI and other bureau data. So when Donna Glenn says she was surprised at the low number of COVID claims, it is not because they do not exist, it is because they are not in their data set. The industry has seen hundreds of thousands of these claims nationwide.

Finally, in their own data set they excluded claims with zero incurred from analysis. Other data sets show around half the reported COVID claims have zero incurred. Many of those zero dollar claims were paid lost wages under federal leave programs. Those zero incurred claims could still develop.

The story of COVID and workers’ compensation is far from over. NCCI said that in their discussion of issues they are monitoring.

Thanks for the note Mark. Hope you and yours are well and enjoying spring in Chicago.

I’m struggling to understand what mistake I made or what sweeping statements you think are mistaken – that said let me attempt to address your concerns.

NCCI has data from most states – although not some big ones including CA and NY. Further I’m not sure how you can say the data is less than 1/3 of industry data; the best source I’ve seen – NASI – indicates total employer costs for WC were $98.6 billion in 2018. By that measure NCCI’s total premium amounts to 45.6% of all WC. Perhaps there’s another source you are using, if so please share.(As costs for all employers went down; I’d guess (always dangerous!) that NCCI’s data accounts for more than half of employers’ WC costs.

Further, the data from CA is pretty consistent with NCCI’s – claims aren’t expensive, there aren’t that many of them, and any negative financial impact of COVID is far outweighed by much lower claim volumes.

I’d note that my statements about WC profits were specific to insurers; if you have other data please share, happy to review and report back if things look different. The data is just compelling – a 24% pre-tax operating margin is just remarkable. Are you suggesting this could disappear? Of course the entire story isn’t written yet, but something truly cataclysmic – and as of now, completely unseen – would have to occur.

I won’t characterize or qualify Ms Glenn’s statement as she didn’t say specifically why she was surprised. Without that I’d just be making an assumption.

Finally I’d suggest that the zero dollar claims actually supports my assertion that COVID isn’t expensive and has not been a problem.

Again if you have other information please provide it.

Be well – Joe

Joe, well done, sir. I wonder how many of the “talking heads” and “empty suits” whose claims to fame are due to their social media presence will own the errors of their ways. I am not holding my breath. A critical skill today is separating the wheat from the chaff, or the Joe Paduda’s from the “Kim Kardashians of Workers’ Compensation.”

Spring is cold Joe….probably a lot like upstate New York…but the summers are beautiful!

I think we can agree that one problem with analyzing workers comp is that there is no single data source. You have to piece things together from multiple sources, which is a challenge. Data can overlap, and some things get missed.

NCCI tells me they think they and the independent bureau have about the same amount of private carrier premiums. WCIRB tells me they think the independent bureaus collectively are larger than NCCI. We know self insured data and the monopolistic states are not captured by any of the bureaus. That’s how I came up with NCCI having around 1/3 of the data.

Thanks for the response Mark. Hopefully that summer weather is just around the corner.

The reason I rely on NASI for data on total WC program costs, medical costs and other data is their report captures the vast majority WC data. NASI’s data sources and methodology are described in detail here.

Briefly, NASI has:

private carrier and state fund data

private carrier and state fund deductible data

guaranty fund data

second injury fund data

self-insured data

self-insured guaranty fund data

NASI also sends questionnaires to insurers, state funds, and other WC payers to ensure their data trove is as robust as possible.

Re the COVID data, in addition to NCCI’s reporting, states are also reporting on COVID’s impact with varying degrees of detail…I wrote on this several times last year – here’s one summary (there are others on this blog)

Data from several states continues to indicate COVID claims are not expensive – and the truly catastrophic claims are rare indeed. IF I can get some time I’ll put together a post on this.

Full Disclosure – I am a member of NASI but have no involvement in any of their research.

Joe, I think Mark makes an important point about the NCCI data. I don’t think the problem is state coverage or how much coverage of the WC market their data represents, as much as it is their industry coverage. Guess what the 2 biggest industries impacted by COVID are; Healthcare and public entities. As Mark pointed out, both are big self-insurance markets with not much NCCI coverage .

I can tell you from my experience that COVID’s impact is very uneven across industries, with some industries experiencing significant problems and others experiencing very little impact. Those industries that were hit hardest and continue to be hit incredibly hard by the pandemic are generating lots of claims, most with little or no loss cost (so far).

Nonetheless, those entities do have a few really expensive claims in the mix. And while my data set is not as expansive as the NCCI’s, I have seen more request for lung transplants (think about those costs) in the past year than I have in through the entirety of the rest of my career. So, while we may be able to declare victory on frequency for some, I can tell you that there are numerous land mines out there to navigate through yet. In addition to these already know big hitters, long COVID claims are out there just waiting to get on a roll and while they may not be particularly expensive today, they will undoubtedly empty some wallets as they age and turn ugly.

Personally, I’m holding my fire on declaring victory because I think we are just now getting into the interesting phase of COVID claims and its impact on the WC world.

Hello Dennis – thanks for weighing in, appreciate your observations.

While I agree that the COVID cost picture is far from complete, I’d suggest there’s enough in sight to pretty clearly see where this is heading.

Re Mark’s point, the only data I’ve seen from self-insured employers (via TPAs) is COVID costs are quite low.

All research indicates medical costs for COVID are generally quite low… Florida reported earlier this year that “37,966 COVID-19 claims were accepted, with 36,024 of them (95%) costing less than $4,999 totaling $25 million. A total of 11 claims cost more than $500,000 each (0.03% of all claims), with insurers paying a total of $10.9 million for the most expensive claims, according to the report.”

Compare this to the all types of cat claims >$500k…which account for 0.5% of all claims. Put another way, non-COVID claims are 16 times more likely to cost more than $500k.

I know, it’s only been 14 months since COVID emerged and we have a lot to learn. However, all the data we have so far – from workers’ comp and private payers and Medicare and Medicaid – indicate COVID’s medical costs are low. There are very few surgeries, transplants, and other very expensive procedures – and those are incredibly rare.

I would argue there’s currently no credible evidence – although lots of speculation – that costs are much more likely to remain low than increase dramatically.

be well – Joe