Private Equity healthcare investment declined sharply last year as the average deal’s value and the number of transactions both fell off.

Firms invested over $45 billion in 167 US healthcare deals last year – a pretty massive decrease from 2021’s 216 deals for $107.5 billion.

While 2022 started off quite strong, deal volume halved in the second half of 2022 due to interest rate hikes, tighter credit, economic concerns and Putin’s War.

Those are the headlines from Bain & Company’s Global Healthcare Private Equity and M&A report 2023 (download for free here.)

note – I have worked with Bain entities in the past, respect the firm and the Bain people I’ve worked with. I am not currently working with Bain.

key highlights…

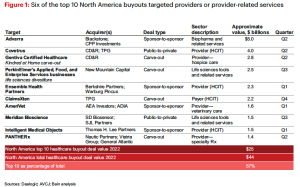

- Provider sector deals accounted for about half of all transactions and dollars invested…but slowed dramatically to 7 transactions in Q4 2022

- IPOs pretty much disappeared in 2022 (initial public offerings, when a private company goes public)

- Value-based care and primary care were a big focus of strategic buyers…

- Optum bought several provider groups

- Amazon acquired One Medical

- Humana and Welsh Carson did a joint venture, investing in a value-based primary care company.

There’s a lot on value-based care…although there’s precious little evidence that it is a panacea, investors are still betting billions …From the report:

For more than a decade, value-based care (VBC) has been positioned as healthcare’s “next big thing.” And while progress has been uneven

The number of accountable care organizations (ACOs) plateaued at around 1,000 in recent years, while 15 of the 53 entities participating in CMS’s direct contracting program in 2021 experienced net savings losses.

Value-based care stakeholders are doubling down on their commitment as healthcare spending outpaces GDP growth and CMS leans further into VBC models.

What does this mean for you?

Expect PE investors to remain quite cautious until interest rates stabilize, the debt ceiling is raised (or much, much better – eliminated) and inflation trends level out.

Warning – if House Republicans don’t raise or eliminate the debt ceiling there will be hell to pay.

Register for Bain’s webinar on the report here.