Didn’t post this week…was in Chicago for the annual father-son trip to watch the Sox play the Cubs…very fun time!

While I was relaxing in the stands, shockingly the world continued turning…

WCRI’s report on long COVID’s impact on work comp was release, examining claims with an average of 18 months post-infection…my takeaways include:

- one out of 19 COVID claims developed long COVID

- medical costs average less than $30k

- temporary disability benefits run a bit above 20 weeks

- Long COVID’s impact on workers’ comp is pretty minimal

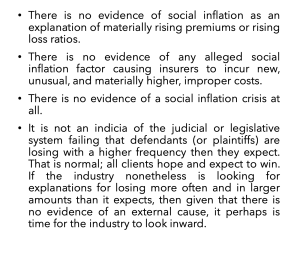

Risk and Insurance weighed in on “social inflation”, a not-well-defined term insurance folks use to characterize their not-very-well-founded belief that society is driving up casualty claim costs. VERY briefly, insurance execs complain that high jury awards to claimants are driving up insurance costs…however there’s precious little real research supporting that view.

This from Ken Klein’s presentation to NAIC in 2022…

What does this mean for you?

Stop catastrophizing until you can prove something exists.

Start catastrophizing when the data is convincing.

Amen. If you need to get a rate increase, find a factual way to explain it rather than using general, vague terms and buzzwords.

Thanks Steve – haven’t seen any credible research or data supporting the definition or existence of social inflation, much less its impact.

III’s effort is…well…kinda funny

“The concept of social inflation is hard to define,” writes Christopher Mackeprang, “which makes it hard to find empirical evidence that supports or disproves it.”2

Notably, whereas much of the discussion focuses on the causes of social inflation, considerably less time is spent examining data for the presence of social inflation.

For this paper, we define social inflation as excessive inflation in claims.

It should be noted that whereas these metrics do not show social inflation for some lines of business, that does not necessarily mean there is none.

Net is the authors don’t know why they failed to predict future claims costs, so they attribute it to “social inflation” – so any unknown thing – say including a logical error or external driver or magnetic field – is defined as “social inflation”.

the paper then goes on to make great leaps of assumption building.

It’s a hoot…but hey, those actuaries can be funny people!

be well Joe