Buyers are asking healthcare intermediaries for “transparency”. We talked about why this is happening yesterday; today I’ll try to concisely describe what this transparency thing is.

The emphasis on try is an upfront admission that a blog post is NOT going to be the end-all and be-all answer. You aren’t going to read a 5000 word treatise on this – and I sure don’t want to write it.

With that caveat, here goes.

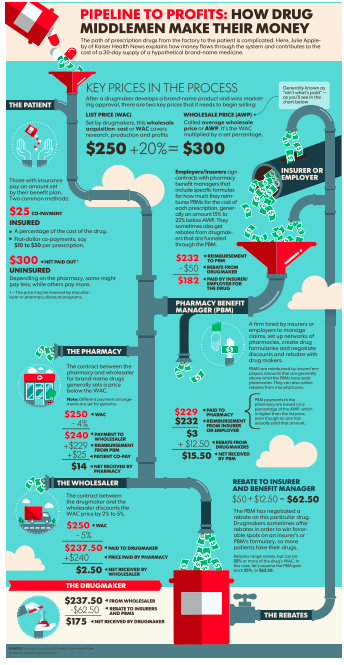

First up, we are dealing with intermediaries or middlemen. Think PBMs, bill review firms, networks; entities that contract with healthcare providers, pharmacies, durable medical equipment vendors, chiropractors etc.; also hospitals. The intermediaries aggregate buyers and providers and provide simple access to and communications, data, and financial flows between those entities.

Let’s take Pharmacy Benefit Management as an example. Of late large benefit buyers have been pushing PBMs to offer transparent pricing options. One, the National Drug Purchasing Coalition, is working with Express Scripts Inc. to provide its members with cost plus admin fee pricing for drugs. That is, buyers know and pay what ESI pays for drugs, plus a per-script admin fee. ESI won’t earn any fees from the dispensing pharmacies or it’s own mail order pharmacy, nor will it capture any rebate or similar revenue. (disclosure – ESI subsidiary myMatrixx is an HSA consulting client)

Express is also offering clients a choice of formularies; to quote the Washington Post, “…clients can choose between lists that include drugs with a high list price — and high rebate…or the new list with lower-price drugs but with little or no rebate.”

And that is one reason this whole transparency thing isn’t as easy or straight-forward as one may want.

Rebates – which in this example are payments from brand drug manufacturers to PBMs to financially incentivize the PBMs to offer their drugs – can be opaque and hard to pin down. Buyers demanding full transparency will want full financial credit for all rebates…but they may also want to keep total drug costs down.

In some cases, those buyers will find that those rebates they participate in mean their total drug costs are lower – while their members may pay more.

This is an admittedly simplistic scenario but one that illustrates the key question – what do buyers want when they say “transparency?” I’d suggest what many buyers want is lower cost – but they aren’t asking for lower cost, they are asking their vendors for a specific thing that the buyer thinks will reduce cost. (Of course, they also want to KNOW that they are getting a fair price)

After lots of analyses and back-and-forth data dumps and algorithm testing and forecasting, what usually happens is…the buyer picks a non-transparent pricing option, that usually has some cost-cap guarantee or other mechanism to manage risk.

What does this mean for you?

There’s a lot to unpack here – but my top three are:

- Ask for what you want as the end result, not a means to get there. Let the vendor figure out how to get you what you want.

- Transparency is defined different ways – make very sure your definitions are consistent within your organization and your vendor partners’.

- When you “go transparent” you’ll have to pay more for stuff your vendor was providing under a bundled price. Call centers, clinical support, formulary management, client and state reporting, script transfer programs…all cost money to deliver.

For those looking for a deep dive into PBMs, pharma, and pricing, here you go! Credit to KHN’s Julie Appleby.

Think i need a plumber

best comment of the week.

Hi Joe,

I agree that healthcare “pricing transparency” is quite complicated, but I thank you for bringing up the topic for your readers to ponder and discuss.

I also agree with you that it is time for all of us to understand how the middleman system works, how it affects both patient care and work comp total spend. It has been a hidden system for decades.

Do you suggest that all intermediaries or middlemen (as you call them, i.e. PBMs, entities that contract with healthcare providers, pharmacies, durable medical equipment vendors, chiropractors etc.) that buy and resell services and products for a profit should disclose to their customers their wholesale prices, rebates and other shared revenue when they submit their bills so that their clients can better understand: (1) how much of what is billed and paid actually reaches the provider of the medical service, and (2) the intermediary’s add-on cost and value? This seems to be even more important for a customer who wants to intelligently purchase products and services that may NOT be of equal value (i.e. different quality, speed, convenience).

Would love to hear your readers’ thoughts.

Best,

Dick Turkanis, M.D.

Hello Dick – thanks for the question.

I most assuredly do NOT suggest that any business entity do that. Whether different entities along the supply chain decide it is worth considering or not is up to them – and their customers.

Value is determined by the customer. As I noted in my example, often times customers ask for something specific when they really want something else. It is incumbent upon the seller to discern what the real goal is and figure out how to deliver on it.

Not sure I inferred that all of us should understand how pricing works throughout the supply chain; frankly the real question is – “does the service/product meet my needs?” I don’t need to know what it costs JetBlue to fly me on the plane I’m on right now; I sure do like the service and value and chose JetBlue over American based on that service and value.

How does the customer know what value is if the profits of the drug manufactures are hidden. If a drug cures a serious illness but only cost $1 to manufacture, is it a value at $1000.00? The drug companies claim they need patent protection to so they can earn back R&D costs, but they refuse to open there books to prove it. . They send much more in advertising then on R&D, and spend more money on lobbyists then anybody. Less money on advertising and lobbying more on lower drug prices.

Hi Joe,

Thanks for you .D.reply. I agree that “value” is a key issue, but I think that providing medical care is quite different from flying an airline… there are many more things that are hard to measure that affect outcome and claim costs (many are hidden) than with choosing JetBlue (which is one of my favorites, also).

I ponder this situation: what if you found out that JetBlue began hiring low-priced mechanics or pilots (with less experience and training), or simply drastically cut the pay of its current employees – in order to make more money? Would that change your value equation?

Go Patriots! Enjoy your SB weekend.

Best,

Dick Turkanis, M.D.

Hello Dick – I’d agree there are any number of variables in medical care that affect outcomes = as there are in any industry. However the key is the outcome measure – we need to start there. And that’s pretty simple to measure depending on the buyer’s values.

Medical care is not too different. Are you treated with respect? Was the experience a positive one? Did you feel you got good value for your money? And for some, is your health status improving?

You refer to the inputs, and ask if knowing some of them would change my value equation. Well, no, which is why I stopped flying American and changed to Delta and JetBlue. Smarter management, empowered employees…better experience. But it wasn’t WHAT management did, it was the effect it had on the customers that was important.