Yesterday’s post covered why work comp is a soft target for “revenue maximizers” – particularly facilities. Today we’ll talk solutions.

First, on a macro level, states need to develop and use fee schedules based on Medicare. For inpatient that’s MS-DRGs – and there should be no outlier provisions. A number of states do just that, and their facility costs are pretty much under control. WCRI has an excellent compendium of state fee schedules etc here.

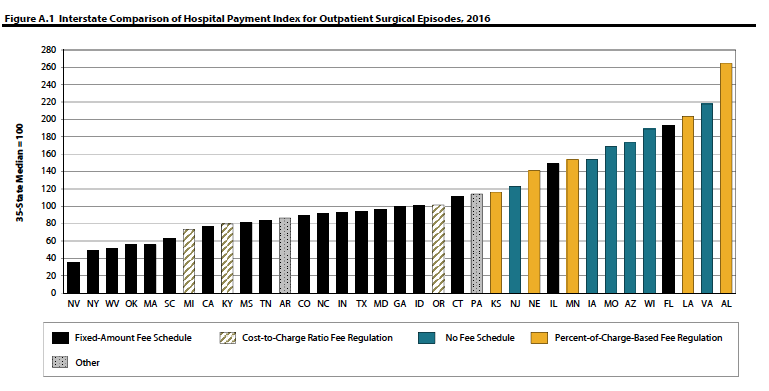

Here’s one chart that shows how effective flat-rate fee schedules are at controlling costs (credit to WCRI’s Olesya Fomenko and Rui Yang)

Second, on a pre-claim level, payers should analyze hospitals’ and health systems’ actual paid amounts to determine what their costs are. Not the discount, the net cost.

Researchers will most likely find net costs are lower for not-for-profit healthcare systems/hospitals, regardless of the discount level. That’s because many for-profits have really high chargemaster prices that they then “discount” so payers can show a lot of “savings.”

Then, wherever and whenever possible direct patients to those lower cost facilities that have equal or better outcomes.

Third, the services have been rendered and a bill for a gazillion dollars appears.

Briefly, unlike group health and Medicare/Medicaid, many work comp payers don’t do much more than apply fee schedules, rules, some clinical edits and check for UR compliance, and perhaps do pre-payment audits. In the Medicare/medicaid/group health world there are both pre- and post-payment approaches, generally known as “payment integrity.”

Going beyond bill review, there’s Payment Integrity solutions. Here’s where I need to turn it over to Anthony Pelezo MD of Equian, an expert in payment integrity solutions (and an HSA consulting client). I asked him how work comp is different from other payers.

Dr Pelezo: [a] key difference between group health (commercial), Medicare and Medicaid versus Worker’s Compensation involves the number of layers of payment integrity, the type of integrity, and the way those layers are implemented. In group health programs we have the core processing platform plus the implementation of at least one if not two large-scale industry editing software packages, and in some cases additional pre-payment fraud, waste and abuse software.

…there may be three or four payment integrity companies scrubbing the same bill set after payment has been made, each finding something that the prior vendor did not detect. In total you may have six or seven layers of protection in place. These key observations served as the impetus for Equian’s formation of a seamless second pass editing solution targeted specifically to Worker’s Compensation programs, one that would impact bill processing in all States. Remember, these are industry leaders in payment integrity – and this speaks to how difficult it is for any single entity or organization to detect ‘all’ improper payments, and frankly how much overpayment is present in any given environment.

I asked Dr Pelezo what payment integrity is and how it is different from bill review:

Dr Pelezo: In its simplest form payment integrity is payment to the right party, for the right medical products and services, in the right amount. In different forms every healthcare payer in the industry deploys various degrees of payment integrity – a worker’s compensation bill review engine in and of itself is a form of payment integrity.

Dr Pelezo: many worker’s compensation carriers are dependent upon bill processing systems and limited internal resources to manage the entire spectrum of payment integrity…the expertise, tools, and funding required to implement effective programs for all aspects of payment integrity is a daunting task (and a daunting ask). Even one ‘simple’ aspect of payment integrity (nothing here is simple) – bill auditing – can be subdivided into professional, outpatient, inpatient, pharmacy, durable medical equipment and supplies, etc. Securing true expertise in each of these individual areas can be difficult. Compound that issue with an ever-changing landscape of payment policies and methodologies and it is easy to see why managing payments is challenging for even the largest healthcare organizations. In bill auditing alone, one has to tackle validating/aligning new State requirements with bill processing outputs, CPT code updates, AMA CPT Assistant code clarifications, evolving specialty society guidance, National Correct Coding Initiative policy updates, hundreds of pages of CMS final rulings that impact CMS-based payment methods, medical policy updates, bulletins and banners, and all other information and reference material that impact how payment should be made.

What are some of the issues you’ve seen with outpatient services?

Dr Pelezo: I continue to see an expansion in billed amounts for outpatient surgical services, especially in those States that pay for services based on ‘usual and customary’ or percent of charge methods. Programs that participate in Medicare should not bill other payers differently than Medicare is billed for the same set of services, from a pure compliance perspective. I’m not convinced this is always the case, however, and I have encountered these variations in Worker’s Compensation data. I’m disappointed when I encounter an ambulatory surgical center bill for hundreds of thousands of dollars for surgeries that last a couple of hours; surgeries that under other programs – lock, stock, and barrel – are only reimbursed a very small fraction of the reimbursement received under Worker’s Compensation. [emphasis added]

What does this mean for you?

One of the fun things about working in this business is finding people like Dr Pelezo whose depth of knowledge and level of expertise reminds me that there’s always a lot more to know – and a lot more we can do.

One thought on “The soft target that is work comp, part 2 – Solutions”

Comments are closed.