Work comp rates continue to drift ever lower, with new declines announced pretty much every week. While this is great for employers and taxpayers, the impact on insurers, TPAs, and the work comp ecosystem is rather less than “great.”

It’s going to end…someday…right?

It always does, but this time around feels different.

Here’s where we are today – and why.

Rates and payroll drive premiums; as we’re at or darn near full employment with pretty static average weekly wages, premiums are likely holding steady or up just a hair.

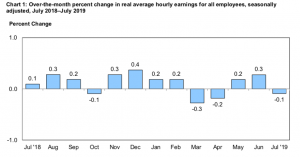

Graph shows changes in average weekly wages adjusted for inflation from the Bureau of Labor Statistics

Florida’s rates will likely drop for a third straight year, New Hampshire employers are even happier as rates have declined for 8 straight years – this time by almost 10%. California – by far the biggest work comp state in terms of premiums, gets another decrease in 2020. Same story in Missouri, Wisconsin, and Virginia.

Rates follow declines in claim costs, so insurers are making tons of money. Historically high profits result from low combined ratios (defined as the ratio of total losses plus admin expense to premiums earned). As long as claim costs continue to drop, profits will remain strong.

Result – insurers are really happy. So are employers.

With work comp medical costs static [see detailed report from NASI, free to download] and claim counts stable-to-lower, there’s little if any growth in the number of claimants, the number of medical bills, and the volume of medical services. This means payers have fewer dollars to upgrade systems, pay staff, invest in improvements and training. As premiums drop, overhead costs get squeezed too.

Think of it this way – a California insurer collects $1 million in premiums this year. If it keeps all its current business and doesn’t gain any new customers, that same customer base = $900,000 in revenue next year. The 10% decrease means 10% fewer dollars to spend on IT, marketing, staff training, process improvement.

The impact on service companies isn’t quite as straight forward – for reasons we’ll dive into tomorrow.

What does this mean for you?

Fewer dollars is good news for some, but is likely preventing many insurers from much-needed investment and upgrades.

The poor value and high hassel of WC for both workers and employers is driving patients elsewhere, hence the trend toward lower volume. So, this is not really a good news story. The good news would be a facile process and reimbursement adequate to attract high quality practitioners, and increased volumes of WC care. Occupation medicine is a complex specialty not well practices by generalists or most musculoskeletal practitioners. More occupational medicine care, which provides the correct diagnosis early in the process and couples it with preventive measures, would be the real good news, but fewer patients are getting specialized care because the WC system has no financial incentives for high value.

Hello George – thanks for the comment as always. I’m not sure how fewer injured workers is bad news.

I’m also not sure about the link between reimbursement and enough providers. While this can be an issue in some states – Massachusetts is a good example – in general access is not problematic. Reimbursement in some areas – Connecticut being one – is quite generous. I’d also note that the low number of occ injuries makes it very hard to determine which providers truly deliver the best care.

Medical costs remain static because there is a fee schedule that hasn’t been updated in years.. There needs to be a regular review of the fee schedule every 1-2 years. Quality care = quality outcomes.

Hello Theresa, thanks for the comment. I’m not sure there is a correlation between fee schedule changes and Worker’s Compensation medical costs. I haven’t seen any research that indicate such a correlation; if you have information please pass it on. I’m also not sure about the relationship of cost to quality, which I infer you are also making. Apologies my inference is in error. Thanks

It has not been our experience that a changed medical fee schedule drives quality care nor, absent a significant change either up or down, overall medical costs within the system. We have seen fewer claims, fewer medical procedures, faster return to life capabilities (return to work for the industry – return to life for injured people), and all with medical fee schedules that get updated (increased) every year. Access to care has been acceptable, although we always need more practicioners and more occupational med specialists.