It is SO GREAT to see faces, shake hands, smile and see it returned, reconnect with colleagues and friends after a looooong two years.

Scroll to the bottom for impacts on P&C and work comp…

Gallagher Bassett’s Russ Pass opened the conference – full disclosure I’m a big Russ Pass fan; he’s incredibly thoughtful, measured, and knowledgeable, and WCRI is lucky indeed to have Russ as Chair.

Dr. Bob Hartwig dove into the impacts of COVID on the work comp line….I had several cups of coffee so felt almost ready to keep up with the estimable Dr. Hartwig.

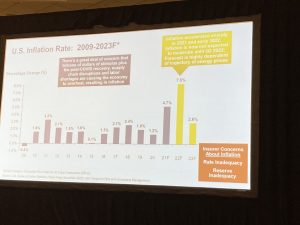

Inflation…

is at a 40 year high, started by supply chain issues, then exacerbated by fiscal/monetary policy, wage increases and now Russia’s war on Ukraine and the impact on energy prices. Inflation is driven by price increases in energy, food, vehicles and “core goods” — NOT from services including medical care.

Oil is going up and down – the China Shenzhen shutdown has cut prices quite a bit as demand falls (that’s my take, not Dr Hartwig’s). We are also a LOT less vulnerable to oil prices now as cars are twice as efficient as they were in 1980.

Hartwig noted that as bad as things are today – they really aren’t that bad. As one who graduated college into high inflation and high unemployment, I heartily agree.

Dr Hartwig noted there’s a 20-25% chance that we enter a recession within the next year…although others think the chances are higher than that. that would have a MAJOR impact on workers’ comp, as employment would drop and we might well see attendant claiming-related behavior.

Hartwig also noted that reserve adequacy might suffer if inflation stays high for a some time. Not sure I see that – WC is WAY over-reserved today so there’s plenty of dollars in the kitty to make up for inflationary pressures.

Part of the driver of the current labor issue is a lot of people have been in and out of the workforce due to illness. That said, about half of businesses are having a tough time filling jobs…as only 82.2% of those in their prime working years in the workforce that’s likely a much bigger driver. Dr Hartwig opined that problems with childcare and fear of contracting COVID along with unemployment benefits are major contributors.

Wages went up over the last year, with average hourly wages up 10.6% from 2/2021 to 2/2022. That’s a lot, especially compared to recent increases which were mostly in the 2 – 3% range for the last decade or so. (Ed note – I’m really encouraged by this – great to see folks in lower wage industries like hospitality get big boosts in their income – well deserved!)

More info…

- Non-farm payroll is back to where it would have been if COVID never happened – that is remarkable/historic/great,

- the “quits rate” seems to have leveled off,

- more of us are retiring – especially the 65 – 74 year olds,

- and more than half of the 55+ are now retired…(what’s wrong with the rest of us??)

- that’s the first time this has ever happened – says Dr H.

- one of the biggest drivers of economic growth is…population growth. As we aren’t making babies like we used to, and for unfathomable reasons are severely limiting immigration – that’s a drag on the economy.

Impacts on P&C

COVID cut premium growth in half – BUT that was still much higher than COVID’s impact on th overall economy.

Work comp saw a 10% decline in premiums in 2020 (not including state funds) – by far the biggest decrease in P&C.

P&C investment yields were 2.6%, the lowest level in 60 years. As interest rates edge up, investment yields will increase.

The overall work comp combined ratio is projected to be 90 in 2021 after an 87 in the previous year. That, dear reader, is super-profitable compared to the line’s historical returns.

Great summaryJoe!

Thx.