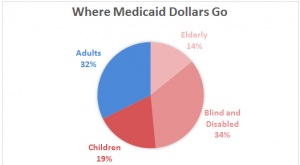

The US healthcare “system” is headed towards a cliff, and when it hits the edge, Medicaid may well be the replacement.

Briefly:

- Managed Medicaid plans would be offered in every state

- people would sign up for the plan they want, with the option of enrolling in regular fee for service Medicaid

- funding would be from payroll taxes, individual service-based fees, and federal funds

- provider reimbursement would be pegged to Medicare for ALL payers, eliminating payer-shopping by providers and increasing Medicaid FFS reimbursement

The details…

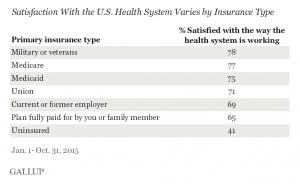

There are two ways this would work – Medicaid for All (MFA) becomes the way all of us get coverage, or Medicare remains in place for elderly folks and Medicaid covers everyone else.

It’s entirely possible employers continue providing basic healthcare coverage, but really, do they want to? It’s expensive and a pain in the neck. Instead, employers will be able to offer supplemental insurance (similar to what happens in Canada, the UK, and other countries) as an employment benefit.

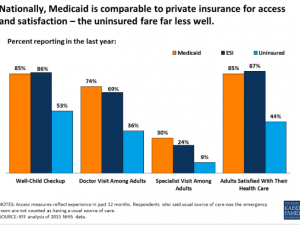

Today, Medicaid comes in two general flavors – “classic” and Managed Medicaid.

Classic is fee-for-service Medicaid, where members can go to any provider that accepts Medicaid. Providers are paid on a fee for service basis, at rates that vary greatly between states (states set reimbursement).

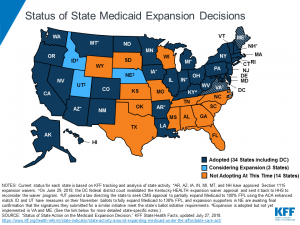

Managed Medicaid is an option in almost every state. The states contract with healthplans to provide integrated Medicare and Medicaid in what are called “dual eligible” programs (members are eligible for both Medicare and Medicaid).

The Managed Medicaid (MM) plans are paid on a capitated basis – that is, a flat fee per member. That fee is based on the health status and health risks of the members; the sicker the member is, the higher the capitation amount.

This arrangement incentivizes MM plans to figure out the optimal ways to keep members healthy and keep costs down – keep them out of the ER, avoid inpatient hospital stays, and encourage healthy behaviors. If costs come in under budget, the plans make money (usually a couple percent at most). If not, the plan loses money – not the taxpayer. (MFA will be based on Managed Medicaid)

(a detailed explanation is here.)

Today, states with these plans in place enroll members in different ways. Some randomly assign members to plans, others allow more assertive competition among the plans for members. I’d expect this to continue under Medicaid for All; existing enrollment processes would be expanded, systems upgraded, and communications refined to address the broader market. Every fall, MM plans would compete for members, enrolling them before the end of the calendar year.

Individual contributions to premiums would be income-based (as under ACA today); there could be low copays for certain services but paperwork for members would be almost non-existent. (All Medicaid members today have ID cards that enable electronic record sharing, billing, and claims submission.)

Funding would be a combination of service-based fees (copays and co-insurance), payroll taxes, federal funds, and perhaps general state funds.

Remember, as employers would no longer have to deliver health insurance, those dollars could be spent on higher wages, to offset payroll taxes, or for other purposes. Similarly, individual payments for premiums, high deductibles and the like would be eliminated, altho some of those “savings” would go to higher payroll taxes to cover Medicaid for All.

Provider reimbursement would be up to the MM plans negotiating with providers – who would remain independent (unless they are employed in a health system that is also a MM plan provider). However, FFS Medicaid reimbursement would be increased to mirror Medicare’s rates.

Why this is the future

US healthcare is not sustainable. Period.

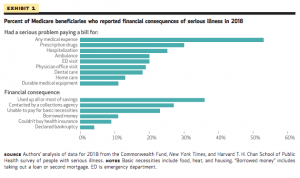

Family health insurance premiums are nearing $20,000, the number one cause for bankruptcy is medical debt, Medicare and Medicaid are the largest chunks of the federal budget, and industrial competitiveness is hampered by healthcare costs which are double the average costs in other countries.

And, 74% of Americans are worried about losing their insurance.

So, we can either keep driving off the cliff, or take an alternate route. One that will be very rocky, cause a lot of headaches and heartache, disrupt businesses and families and providers, but one that sooner or later, we’ll have to choose.

What does this mean for you?

It’s not a matter of if, but when.

Note – happy to engage in fact-based, citation-supported conversation. “I heard this” and “everyone knows” arguments are not helpful.