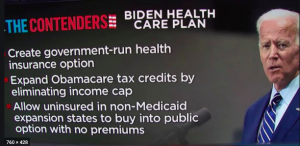

Yesterday we discussed Presidential candidate Joe Biden’s healthcare plan.

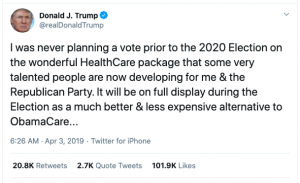

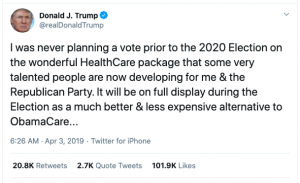

Today we’ll do the same for President Trump’s healthcare plan, which was promised to be ready before the upcoming election…

Five times this year President Trump has promised he will unveil a replacement for “Obamacare”. As of this writing, I have not been able to locate any such replacement plan documentation, web pages, policy statements or plan descriptions other than a couple described below. If you have any details, please share in the comments section below.

It’s not just me – Forbes wasn’t able to locate the President’s plan.

So, if you are looking for a brief explanation – you can stop reading here.

For those who want more detail, here it is.

Unfortunately it appears the White House’s healthcare page has not been updated since 2017 so we will have to rely on public pronouncements and speeches.

Trump’s campaign site does have a list of objectives, but no actual plan, policy description, or details on how these will be met:

This has made it rather difficult to analyze Trump’s plan, so we will have to use the President’s pronouncements to assume what his plan will be. Please note that wherever possible I have cited official White House or Trump Administration sources below.

Pre-existing conditions

The President has repeatedly stated that his plan will require “health insurance companies to cover all preexisting conditions for all customers,” including during a press briefing in early August. In that briefing, Trump stated:

Over the next two weeks, [emphasis added] I’ll be pursuing a major executive order requiring health insurance companies to cover all pre-existing conditions for all customers. That’s a big thing. I’ve always been very strongly in favor — we have to cover pre-existing conditions. So we will be pursuing a major executive order, requiring health insurance companies to cover all pre-existing conditions for all of its customers.

This has never been done before, but it’s time the people of our country are properly represented and properly taken care of.

[note – requiring health insurers to cover pre-ex conditions is imbedded in the ACA (sometimes referred to as Obamacare) and is the law of the land today as that provision of the ACA remains in effect.] source cited is US Dept of Health and Human Services, part of the Trump Administration

Takeaway – taking the President at his word, any new healthcare plan will provide coverage for pre-existing conditions. We do not know if the Trump Healthcare Plan will allow insurers to charge extra for that coverage, or limit coverage to some dollar amount. (that is not allowed under the ACA)

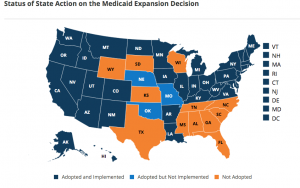

Medicaid changes

Trump has sought to end Medicaid expansion, change funding, and institute work requirements. While these all sound good in sound bites, like many complex issues things sound a lot less good when you peel back the curtain.

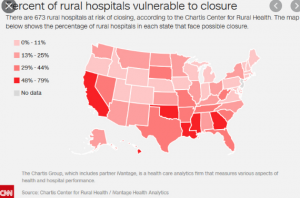

Ending the expansion of Medicaid would crush hospital financials, especially in rural, western, midwestern and southern states. In many areas Medicaid is a critical funding source for facilities; those states that have expanded Medicaid (including deep red Oklahoma) would be in dire straits if the rug was pulled out from under them.

The President has pushed hard to change the way Medicaid is funded to a “block grant” method. Essentially a block grant is a fixed amount of funding; this would replace part or all of the current funding which is based on a percentage of expenses.

Simple in concept, this is much harder to implement, and completely unsuited to our current situation where Medicaid enrollment is rapidly growing due to the fallout from COVID. We haven’t heard much about block grants of late from the President, so not sure if they are still under consideration.

The same is true for work requirements. Many low income folks don’t have internet access, which is required to submit the detailed documentation required under state Medicaid work requirements. Then they need reliable transportation to get to work – which many don’t have. And there are few jobs available these days in many states due to COVID.

Takeaway – Trump wants to end Medicaid expansion, change its funding mechanism, and require some recipients to work. It is highly doubtful any of this will happen.

Drug prices

The President has authored several executive orders around drug prices, but didn’t follow through on actually implementing those orders.

Trump’s move appeared to be intended to force pharma manufacturers to the bargaining table, but that hasn’t happened. Despite Trump’s statement that he would take unilateral action if pharma didn’t cooperate with him by August 25, he didn’t follow thru on that threat.

More troubling, pharma execs don’t know anything about any meeting or discussion.

Takeaway – no significant action to control drug prices is likely.

What does this mean for you?

It’s really hard to say.