We are in the opening inning of the Covid-19 pandemic, so forecasting where this will end up is a fool’s game.

That said, we know and can confidently predict a couple things well worth considering.

Small business

A lot of small businesses will not survive. Retail, hospitality, restaurants, entertainment, sports-related venues and service providers, events centers are all empty or close to it. The many companies that support them, operate them, clean them, staff them, deliver services to them have little cash coming in. Unless they have major cash cushions or lots of untapped credit, these companies are in trouble.

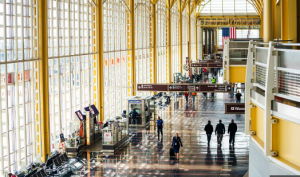

Washington National Airport – think of baggage handlers, shops, cleaners, restaurants, drivers…

Current workers’ comp patients

Care delays – I’m hearing from a broad spectrum of healthcare providers that patients are not going to scheduled appointments or using related services. That’s not surprising; with guidance from many states to avoid non-essential travel and contact, people with medical issues are loathe to risk exposure to the coronavirus.

Over the near term, that bodes ill for the providers and the companies/services doing the scheduling and coordinating care.

Over the near term…

When things return to normal – which they will – there’s going to be a backlog of patients demanding appointments and medical care and transportation and imaging and therapy and surgery. So, the networks and providers will find themselves slammed with appointment requests.

The service companies’ challenge is to survive this big dip in demand – and the cash flow crunch that will inevitably follow – so they are ready when their services are needed.

Increased disability duration

Those out of work due to an injury or illness may well be out of work longer than one might expect – especially if they are in energy production, airlines, services, retail, or hospitality. Their jobs may not be available until things get normal again, so we can expect disability duration, and associated indemnity costs, to increase over the near term.

More worrying is the current debt crisis – way too many families and businesses have way too much debt. They’ve been surviving on revolving credit that has been historically cheap. Mortgage interest levels are historically low, other consumer credit rates are as well, and lenders have thrown money at companies that never should have gotten thru their front doors.

(I wrote on this in detail back in October, here’s a quote:

The Feds are backing $7 trillion in mortgages, way more than they (us) did before the debt crisis of 2008. With taxpayers holding the bag, mortgage lenders have no reason to not give mortgages to people who can’t afford them to buy over-priced houses. The Feds then package those loans and sell them off to other investors.

In fact, fully half of new FHA mortgages consume more than half of the borrower’s monthly income.

Then there’s regular consumer debt; this from a post back in August of last year:

Consumer debt is really high right now, at 19% of income. When people lose their jobs, they default on their loans and credit card debt, cut back on purchases, and that will further harm retail, construction, durable goods (think washing machines and cars). It can take a long time for people to dig out of these holes, and when they finally do, they are very wary of spending – and absolutely hate debt.

As credit dries up – which will happen – folks with mortgages they can no longer afford and crushing credit card bills are going to do everything they can to keep the cash flowing.

That will likely translate into increased claim duration.

The good news is work comp insurers can afford this. Insurers are flush with cash, have huge reserves, likely have benefited from the general increase in bond prices, and historically low combined ratios (claims plus admin expense divided by premiums)

What does this mean for you?

It is more important than ever to be clear-eyed and observe what’s going on outside workers’ comp. Because comp doesn’t affect the real world – the real world drives comp.

Look forward to your insight in a future post on COVID-19 as an “Occupational Illness in the ‘scope and course of employment’ for healthcare workers, paramedics and others who are exposed

Thanks Ann – will do

Joe,

There is also the new claim perspective to discuss. First responders and those in the health care industry may be exposed to the virus, depending on where they work, which will likely introduce a new class of claim with the potential for death claims. Many other classes should be dramatic decreases in claim frequency.

Some employees may contract the virus at work. It is unclear if someone who gets the virus at work from a fellow employee could successfully argue that their illness is arising and out of the course of employment. Various jurisdictions administering the state’s laws could interpret that very differently.

Some employees who lose their jobs may file claims as well. The WC landscape will be very different in 2020. It will depend to a good degree on the specific book of business and the economic strength of the insureds.