When recessions hit, workers’ comp, healthcare, and healthcare delivery systems are deeply affected. Jobs are lost and so are benefits, claims decrease than increase, injured workers don’t have jobs to return to.

There are some indications that we may be on the cusp of a recession today.

- The inverted yield curve (short term interest rates are lower than long term rates) is one clear sign,

- ” weakness in auto sales, industrial production and aggregate hours worked” are also factors, as is

- the weakening economy (growth fell from 3.1% in the first quarter to 2.1% in the April to June quarter).

- Job growth has fallen to 140,000 a month, down from 220,000 just a few months ago, signaling employers are being more cautious about expanding

- The trade war is hammering agriculture and manufacturing, with Goldman Sachs estimating it has cut GDP 0.6% so far. That’s going to get worse when the latest round of tariffs kick in, with some slated to start in 2 weeks.

One of the few positive signs, initial jobless claims, remain stable which argues against a recession.

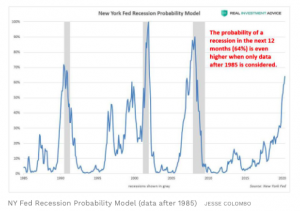

The New York Fed’s recession probability model is currently warning that there is a 30% probability of a recession in the next 12 months. The last time that recession odds were the same … was just five months before the Great Recession officially started in December 2007.

When the model is updated to use current data, the odds increase to 64%.

How long will it last?

Likely longer than the Great Recession of a decade ago, for a number of reasons:

- to get the economy moving during a recession, officials lower the Fed funds interest rate, making it cheaper for companies and consumers to borrow money and buy stuff. This jump-starts the economy. But the Fed funds rate is very low already, so there isn’t much room to lower rates and increase demand.

- if the Fed can’t lower rates, it can try “quantitative easing”, which is a fancy term for the government buying its own debt. This dumps more dollars into the economy, dollars that – hopefully – are spent on new plants, equipment, houses, and washing machines. The problem with “QE” is that its impact is uncertain at best; it’s unclear if it made much of a difference last time around.

- Consumer debt is really high right now, at 19% of income. When people lose their jobs, they default on their loans and credit card debt, cut back on purchases, and that will further harm retail, construction, durable goods (think washing machines and cars). It can take a long time for people to dig out of these holes, and when they finally do, they are very wary of spending – and absolutely hate debt.

There’s another factor that’s both difficult to measure and, I’d argue, much more troubling.

The trade war, Trump’s on-again-off-again tariffs, the elimination of area-wide trade agreements all make business extremely nervous. Businesses thrive in stability, and don’t when they can’t predict what’s coming.

Columbia, Neato Robotics, Wolverine, John Deere, and Caterpillar are all hamstrung, unable to predict what their supply chain costs will be, how tariffs will affect the price of their products, and what sales will amount to. As a result, they’re hunkering down; Moody’s estimated 300,000 jobs have already been lost due to Trump’s trade war.

We’ve already seen the Chinese shift agricultural purchases from the US to Brazil. This has hammered Deere and Caterpillar, as well as their local dealers, and the manufacturers that make up their supply chains.

What does this mean for you?

Watch indicators very carefully, be objective and rational, and remember that fortune favors the prepared.

The good news is those who are clear-eyed and thoughtful can do well; for work comp businesses, remember:

- claims drop, then increase;

- duration increases;

- premiums decline as payroll does.

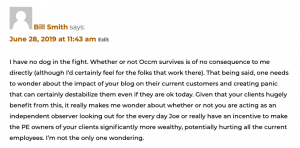

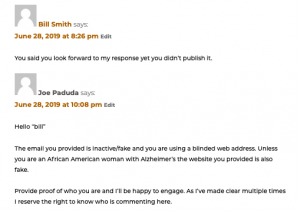

Here’s where I should have been more clear. I should have posted the actual website address “bill” used in his original post so you, the reader, could see for yourself that what this troll was up to.

Here’s where I should have been more clear. I should have posted the actual website address “bill” used in his original post so you, the reader, could see for yourself that what this troll was up to.