The internet, smart phones, electric vehicles, 9/11, genome sequencing…a lot has changed since 1990.

But in workers’ comp…not so much.

About 30 years ago OUCH (now part of Coventry) started the national workers’ comp PPO business. Liberty Mutual execs (literally) handed OUCH a bunch of three-ring binders stuffed with contact info for the providers Liberty used, and asked OUCH to build one of those new network thingies.

OUCH did just that, then went out and marketed its network to every WC payer, merged with HealthCare Compare, became FirstHealth then Coventry Workers Comp, merged with Concentra’s PPO along the way, and got sold a couple more times.

Outside of several name changes, nothing has really changed since that fateful delivery of intellectual property.

Sure, there’s been a lot of talk about “outcomes based networks”, but uptake has been minimal. Reimbursement is still based on fee-for-service (the more service, the more fees), quality assessment is poor to non-existent, and buyers measure PPOs based on how deep the discounts are and how thick the provider directory is. Specialty networks have carved a big chunk out of PPOs, but many payers still access specialty services via their PPO contracts.

Networks charge payers a percentage of the discount below fee schedule/U&C – so the higher the charges, and the more charges there are, the more money the network makes. And the higher employers’ medical costs are. (I CANNOT BELIEVE I AM STILL WRITING ABOUT THIS AFTER 17 YEARS)

There were some promising attempts to do things differently…Sixteen years ago Crawford and Liberty Mutual got into the predictive analytics business.

“…Liberty Mutual uncovered what it believes are the two keys to managing workers’ comp medical costs.

First, the statistical averages for treating specific injuries in any city or state – for example, how many office visits are needed to heal a torn rotator cuff in Denver, or what does it cost to set a compound arm fracture in Pennsylvania. Second, how individual caregivers and facilities in the area compare to that baseline.”

Coventry started their Outcomes-Based Networks, some California payers (the State Fund being the leading example) set up their own tight MPNs, and the WC Trust of CT built a terrific network for its customers. While laudable, these are exceptions.

I get WC predictive analytics is really knotty for a host of reasons, but here we are, in 2021, with most payers having made little if any progress managing cost – and with the exception of pharmacy and some specialty niches – no progress on quality.

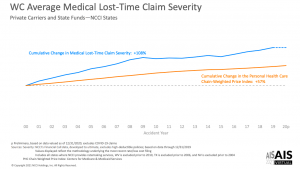

This is why lost time claim medical costs per claim have doubled since 2000.

It is also why workers’ comp medical costs are set to increase this year and the ones to come.

What does this mean for you?

Until employers demand better, it won’t be.